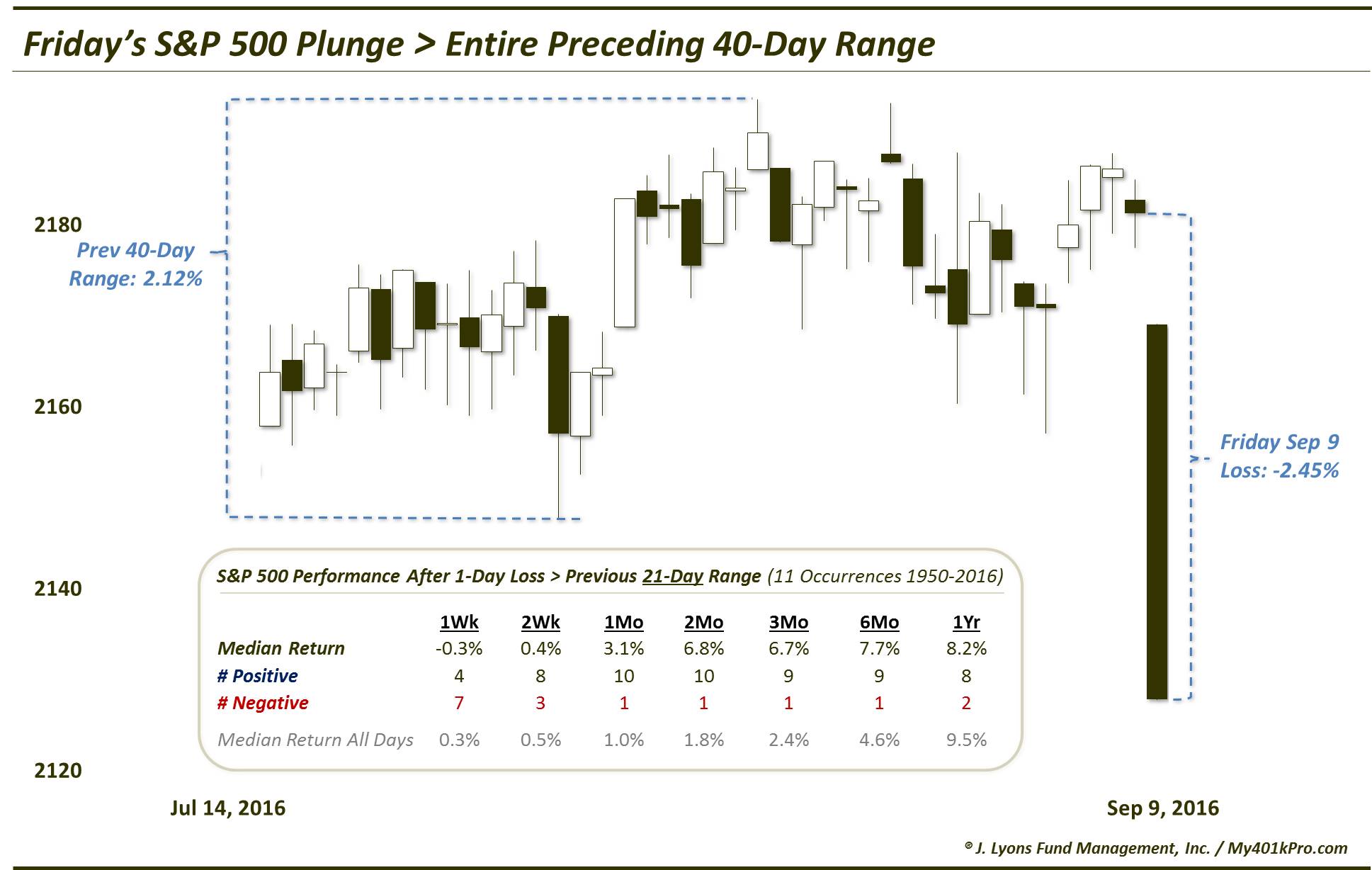

Market's sideways movement continued. This sideways action is now 2.5 months long. SP500 has gone sideways in the last 2.5 months, as shown from teh chart below:

SP500 was at the level where it closed yesterday on July 12, and since then it has gone sideways. It is like a coiled spring, waiting for an explosive move.

At the same time, longer term DJIA structure also looks like a market consolidating before next rally phase.

From market structure perspective, seems like DJIA is tracing out an ending diagonal which is near completion. Market might require one more decline before putting in a substantial bottom.

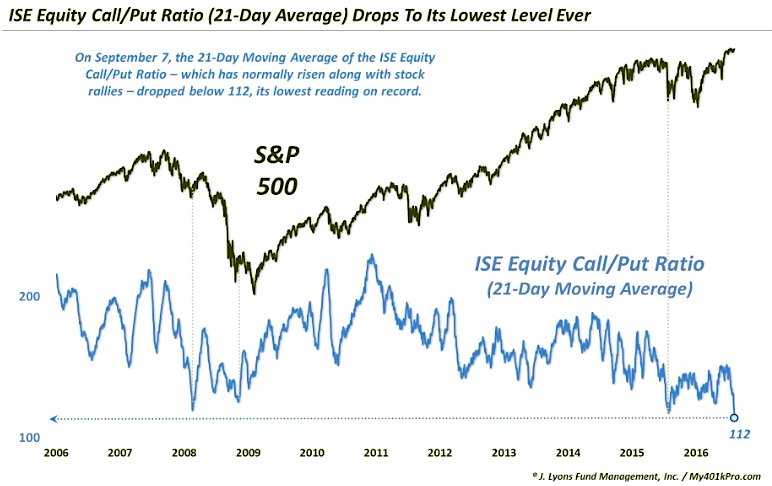

This sideways action has removed a lot of optimism from the market and pushed many investors on the sidelines. According to Market Classification Model we remain in an uptrend. And this consolidation should be treated as a buying opportunity till the time, market turns and shows that the trend has reversed.

If interested in free e-mail list or in paid services, please fill-out the form below.

SP500 was at the level where it closed yesterday on July 12, and since then it has gone sideways. It is like a coiled spring, waiting for an explosive move.

At the same time, longer term DJIA structure also looks like a market consolidating before next rally phase.

From market structure perspective, seems like DJIA is tracing out an ending diagonal which is near completion. Market might require one more decline before putting in a substantial bottom.

This sideways action has removed a lot of optimism from the market and pushed many investors on the sidelines. According to Market Classification Model we remain in an uptrend. And this consolidation should be treated as a buying opportunity till the time, market turns and shows that the trend has reversed.

If interested in free e-mail list or in paid services, please fill-out the form below.