Over the past few days I have been seeing several bloggers,

who missed the 12% rally from Nov bottom to January high, suggesting that the

market is carving out an ending diagonal. And once this pattern is completed,

we will fall of the cliff. Proponents of this pattern include Elliott Wave

followers and chartists. However, based on UST’s Market Matrix analysis and

proprietary trend indicators, it is highly unlikely that we are in an Ending

Diagonal pattern. In the end, all those who are promoting the Ending Diagonal

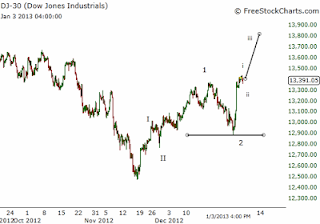

concept could once again miss another buying opportunity. UST's primary E/W count is presented here.

First of all, let me be very clear that Ending Diagonal

patterns are a reality! They do exist. And they do result in sharp moves in the

opposite direction. Ending diagonal patterns are defined as:

And they look like:

Following DJIA chart shows an ending diagonal drawn in the

current market. There are many aspects of this ending diagonal which fulfill the

technical requirements of this pattern.

|

| DJIA - Weekly Chart |

|

| DJIA - Daily Chart |

Characteristics of

this Ending Diagonal:

- Structure: Market traced out the ending diagonal pattern in an overlapping manner. Moreover, sub waves are seen as divided into 3-waves instead of 5. 5-wave advances suggest impulsive rise, while 3-wave and overlapping advances characterize correction or ending diagonal.

- Rapid Rally: This pattern has formed after more than 100% market rally in less than 4 years, which can be classified as a sharp rise. Therefore, sharp rise requirement has also been satisfied.

- Sentiment: Sentiment on this latest up move has touched extreme optimistic levels - levels not seen in many years. Therefore, it meets the requirement of optimistic extreme.

- Divergence: Finally, there is a clear divergence between large cap indices like DJIA and SP500, and Nasdaq. This divergence can be a negative omen for the overall market, as divergences typically occur towards the end of an advance.

Although above mentioned reasons support the possibility of

an ending diagonal being formed, there are several reasons why the Ending Diagonal pattern assumption is doubtful. These reasons are based on personal experience,

market’s analytic study and interpretation of Elliott Wave pattern in

light of Market Matrix indicators/IPM Model.

In order for the market to confirm an ending diagonal, we

need to see a very sharp decline, which will break below Nov 2012 lows.

However, following reasons do not support the concept of a sharp decline.

Market developments

that do not support Ending Diagonal:

- Internal market strength is very strong, which suggests that we have further rally left

- Recent rally saw a market breadth spike, which has previously been a sign of further gains after a brief pause.

- Start of new Bull market in Global Markets and Emerging Markets (A special report was emailed to subscribers in early December highlighting this development). A new bull market typically lasts longer than only 2 months.

- A lot of people are publicizing and accepting this pattern, as logical next step. I have noticed that whenever a pattern becomes public news, it rarely happens

- No major sell signal yet e.g. 8/4 test etc.

Conclusion:

Yes we will see a market decline, but it will not be because

of Ending Diagonal. Instead it will be because of Elliott Wave pattern shown on

the UST blog, IPM Model top date, elevated Sentiment, trend line resistance, and

overbought conditions. People who believe in the ending diagonal will go very

short on this decline, and will most probably not cover at the bottom. Hence,

they will not only not make money based on their ending diagonal belief but

will also miss the upcoming rally. In order for our E/W count to remain intact,

market should not decline below …

Weekly IPM Model:

Latest IPM Model run on the weekly time frame resulted in a

very unique output. This output will be shared with subscribers in next 1-2

weeks.

Subscription

If interested in IPM Model Subscription, please fill out the form below. IPM Subscription will be closed after a limited number of subscribers to maintains models validity. Model Performance