2018 has been an year of many lessons. This year we have seen severe volatility across assets classes ranging from stocks to bonds, and from crypto assets to fiat currencies. This type of volatility has resulted in many high-profile casualties, where some hedge funds had to close because of substantial losses while other prominent fund managers are severely under-performing. For example, David Einhorn's Greenligh Capital is down -18% in 2018 through July. Such volatility also brings valuable lessons because it stress tests the investment methodology, process and approach, in a real-world environment, rather than in paper trading. One such lesson is the importance of risk management.

One important part of investing is that it is never stagnant, whether you invest in the stock market, bond market, real estate, digital assets, or world currencies. Investing also comes with inherent risks, and as you know about risk: No risk, no gain; high risk, high reward; low risk, low reward." However, the problem with risk-taking is many people do not understand how do you manage risk. This concept of risk management is very important because it not only helps in investing but also in other aspects of life.

In investing, risk management means that you adjust your portfolio and positioning to align with the most likely scenario, and avoid chasing anything at or below 50/50 chance. One of the best example of this in personal life is going to school. One goes to school and then college, spending money on tuition and living, in expectation of reward through professional growth and earnings. Why would one go to school if the possibility of personal/professional growth is only 50%, which would mean there is no point in spending money and working hard if one has 50% chance of growing without hard work.

Similar is the case with investing. We should invest where we expect our value to grow over time while understanding there will be times when things will not go according to plan. For example, many college graduates are laid-off but they bounce back. Similarly, in investing there are periods of great performance, and then there are times when the position moves either against you or doesn't do any thing. This is one of the primary lessons from personal investing career in 2018:

There are times when you make money, and then there are times when you protect what you have made.

This is very important and is a big part of dynamic risk-management. Through risk management, our strategies ensure that investors and their portfolios are prepared for draw-downs, both mentally and through appropriate positioning. In this regard, dynamic risk-management ensures that portfolio keeps dynamically updating based on market realities, and it is not left on the market to decide its fate.

One of the best examples in this regard are digital currency assets. Many investors entered the crypto markets in late 2017 in hopes that the crypto-currencies will go to the moon above what they had already realized through mid-2017. Not surprisingly, they peaked in Jan 2018 and have since declined over 90% in most cases, while the poster-child of the crypto asset world - Bitcoin, is down almost -70% from the top. Many investors have been adding to their holdings all the way down, and have very recently started hoping for a rally to exit. This is a prime example of lack of risk-management.

Investors who managed their risk had defined exit points. Whether they entered early or late, they exited based on risk-management parameters. As a result, they are now waiting to invest again with less stress on a daily level. Effective risk-management helps in the following ways:

- Avoid persistent losses

- Maintain composure

- Prepare for new ventures and investments

While a traditional investment cycle could go from dis-information to disbelief to hype to hysteria to hope and then to demise, effective risk-management helps break that cycle while keeping the investor objective in their investing regimen. This would help protect investors from major losses. This brings us to the next lesson:

Gains are relative. There are periods of high and low return. Consistency is the key to long-term success.

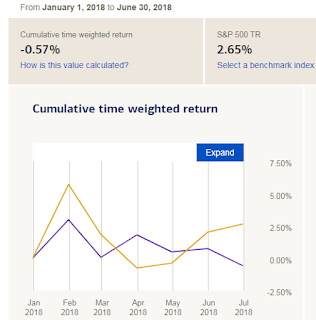

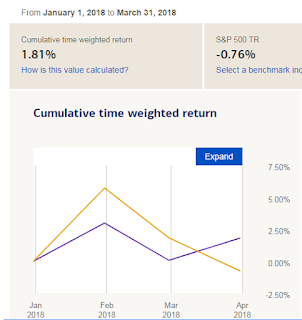

This leads to a big question. If someone keeps investing in a sinking ship, how is that a wise decision? That is where risk management gains even more importance. One needs to consistently and preferable dynamically manage risk to ensure consistent investments are not made into sinking ships. This is what we try to do. We focus on entry, exit and current allocation levels to manage portfolio risk. This is accomplished through proprietary indicators and signals that span across fundamental and technical spectrum of markets. As a result, we don't promise and suggest that we will maximize the gains in an up-market but ensure that portfolios don't blow-up in case of extreme volatility events like of 2018. And we have seen in 2018 that while many famous investors faced difficulty, volatility of our portfolios always remained in check.

This has helped generate significant gains in 2016 and 2017. And ensured that our approach allowed investors to keep investing in a difficult 2018 market, so that when the volatility subsides or major themes become apparent, the investment base is larger and takes the most advantage of the gains. Some might use concept to defend the dollar-cost-average strategy, major problem with $-cost-average is the sinking-ship scenario. However, if you can invest in a sound risk-managed portfolio, in the long-run you will not be investing in a sinking ship, and therefore, the #-cost-averaging should yield significant long-term gains.

Before ending, I would like to share another lesson from 2018 related to investor participation in a bubble in any asset class but was very clear in case of Bitcoin and crypto currencies:

When the world enters, it is time to exit no matter how attractive it might seem.

This is easier said than done without a sound risk-management system because you could end up seeing your investment go up 300% without you. This is something that I have painfully experienced in the past. Therefore, in order to mitigate these risks and to take advantage of the benefits associated with effective risk-management, we dynamically manage the risk in our strategies. While this risk management sometimes results in lower near-term performance, it reduces portfolio volatility, keeps us unbiased, positions us for major investments, ensure that external noise doesn't influence the portfolio construction, and help generate consistent performance.