Markets rallied very sharply today. This is in line with the IPM Model analysis that was sent to subscribers.

However, it gets very interesting at current levels. Today's rally came on the heals of Federal Reserve's tapering decision. Ben initiated the tapering processing before he left, so that Janet doesn't get the blame for tapering. And Janet can continue with tapering over the coming years.

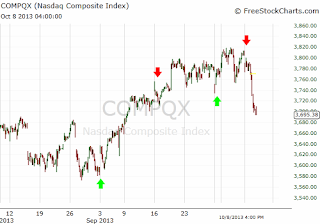

Pretty much everyone knows that tapering could be bad for stocks. And in response stocks staged a nearly 300 point rally, which took many market participants off-guard. However, there are several reasons for concern about today's rally:

However, it gets very interesting at current levels. Today's rally came on the heals of Federal Reserve's tapering decision. Ben initiated the tapering processing before he left, so that Janet doesn't get the blame for tapering. And Janet can continue with tapering over the coming years.

Pretty much everyone knows that tapering could be bad for stocks. And in response stocks staged a nearly 300 point rally, which took many market participants off-guard. However, there are several reasons for concern about today's rally:

- Rally did not trigger breadth based buy signal, which is bad. This means we will not see a long lasted rally phase.

- There is divergence between DJIA and DJ Transportation average

- SP500 is still below December 9th peak

- Russell 2000 did not rally as aggressively as DJIA

- Weekly IPM Top is still in play, till new high is made

- Next Daily IPM Turn date suggests that we will soon see further decline in the market

- MFI based timing model also had a sell signal during 12/9/13 top.

- Elliott Wave analysis suggests that we just saw a wave 2 rally, which will be followed by a persistent wave 3 decline. This decline could last for several days (if unfolds).

- Global Stock Markets are declining. Some markets like FTSE 100 have entered a bonafied down trend by completing the 8/4 Test on a weekly time frame.

In conclusion, today's rally might be a classic bull trap. This assumption will be invalidated by a market rally above 12/9/13 top in several markets such as Russell, SP500 and DJ Transports.