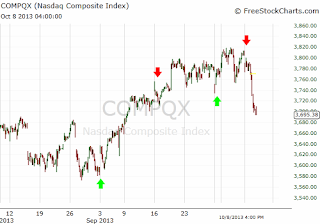

Its a very confusing time for trading. On one hand there is discussion about potential resolution of the debt-ceiling and government shutdown issues. And on the other hand, there is a confluence of technically time-tested indicators suggesting that there is a significant potential of market decline ahead.

From a Bull Perspective:

- It is difficult to quantify the decline from an Elliott Wave perspective. Whenever such situation arises it begs the question whether recent decline was only a sideways correction. And from an Elliott Wave perspective, it seems like a sideways correction. Therefore, we should be expecting further rally.

- Today, we are also hearing about potential resolution of stalemate between congress and the president.

Bear Perspective:

- Trend has turned down in DJIA

- IPM Model top window is at hand. IPM model turn window has a success rate of 90%+.

- One of the indicators (very good success rate) is suggesting continued decline

- Lower high within IPM model top window is always a bad omen. Results in a downtrend 95% of the time.

Therefore, it is one of those times where we should let market decide its direction. If I am to take a guess, I would go with further decline. But in any case, we should make a trading plan to eliminate risk from trading. And for current trading plan:

Go Long: If market goes above XXX, after xx October. Rally might continue till next IPM turn window (will be emailed to subscribers).

GO Short: If market goes below YYY, by xx October. Decline will resume for next few weeks.

No comments:

Post a Comment

I would love to hear from you! Please leave your comment below!!