Although both Bull and Bear scenarios are equally important, I would personally like to see the Bull scenario unfold because it helps everyone and the economy. However, let's first discuss the potential bear setup, especially at a time when the market is rallying ahead of the Brexit results.

Bull or Bear, market will soon adopt either direction. And July's Q2 earnings will justify the move.

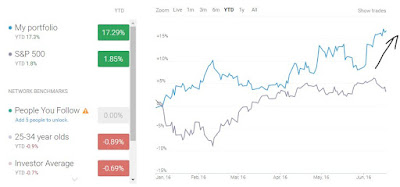

As of now, markets are in a neutral territory. Last time, our proprietary Bull/Bear model went neutral was in August and since then we have been out of stocks. In January, model went short for 3 months and is now again neutral. We have seen that markets have not managed to break-out in over a year. For some market observers this is a sign of accumulation or digestion of prior gains an will result in further gains, but let's not forget what happened to oil.

Following charts shows SP500 and Oil. Oil went sideways for 3 years (2011-2014). While many believed that this sideways action was a harbinger for future rally, Oil fell off the cliff - from $110 - $25.

Can this happen to stocks? Probably...

In support of the above argument, following chart shows a potential Elliott Wave count in Global Dow index, which suggests that the markets are about to fall in a big way in 3rd wave down.

Now, Elliott Wave analysis is only valid when its accompanied by market internals and sentiment. As of now, the sentiment indicators are bullish which reduces the market's fuel for a sustained rally. At the same time, Commitment of Traders, especially in Dow Jones Industrial Average, is at a very elevated level. This typically coincides with a top or pause (shown below).

Conclusion

This analysis shows that the market is near the end of its up trend. However, that's just one side of the story. In our prior post, we also highlighted potential Bull reasons and we will discuss these further in the next few posts.

As for the portfolio allocation, proprietary model will define the allocation based on key proprietary indicators and latest macro-economic developments. In any case, the model will quickly align itself with the new reality and market dynamics.