Monday, October 28, 2013

Wednesday, October 16, 2013

Up, Up and Away!!

Financials are ready to break out. Earnings season has started.

Financials have been consolidating for the past few months, since May. From May to October, 5 months of consolidation have refreshed financials. They can now rally, along with the rest of the market.

Rally might extend to weekly IPM Model top date.

Financials have been consolidating for the past few months, since May. From May to October, 5 months of consolidation have refreshed financials. They can now rally, along with the rest of the market.

Rally might extend to weekly IPM Model top date.

Tuesday, October 15, 2013

IPM Information

As I am on international travel, IPM Model software is not working. I am trying to resolve the issue. Update will be sent to subscribers as soon as possible.

Tentative

Next turn date = Top,

New high after last IPM Top Date October 7 => Continued rise

There is a high potential of a rally till end of October

Thursday, October 10, 2013

Tomorrow will be a Big Up Day but then...

It is getting very interesting. I think, I finally have a good understanding of the market's Elliott Wave structure. And according to this structure, we might one more high before the Top is in.

Can that Top today? This is the big question!!

Can that Top today? This is the big question!!

Is this a Chance to Go Short or Long??

Its a very confusing time for trading. On one hand there is discussion about potential resolution of the debt-ceiling and government shutdown issues. And on the other hand, there is a confluence of technically time-tested indicators suggesting that there is a significant potential of market decline ahead.

From a Bull Perspective:

- It is difficult to quantify the decline from an Elliott Wave perspective. Whenever such situation arises it begs the question whether recent decline was only a sideways correction. And from an Elliott Wave perspective, it seems like a sideways correction. Therefore, we should be expecting further rally.

- Today, we are also hearing about potential resolution of stalemate between congress and the president.

Bear Perspective:

- Trend has turned down in DJIA

- IPM Model top window is at hand. IPM model turn window has a success rate of 90%+.

- One of the indicators (very good success rate) is suggesting continued decline

- Lower high within IPM model top window is always a bad omen. Results in a downtrend 95% of the time.

Therefore, it is one of those times where we should let market decide its direction. If I am to take a guess, I would go with further decline. But in any case, we should make a trading plan to eliminate risk from trading. And for current trading plan:

Go Long: If market goes above XXX, after xx October. Rally might continue till next IPM turn window (will be emailed to subscribers).

GO Short: If market goes below YYY, by xx October. Decline will resume for next few weeks.

Wednesday, October 9, 2013

September IPM Model Update Review

On September, the IPM Model update predicted the following (Link to Document):

Scenario 1: Market Rises with brief Sideways Action & Tops around 10/7 (High Prob.)

Reasoning: Above mentioned fundamental reasons are very well known. And therefore, many

people will stay away from the market during this time because market likes to fool the

majority. Furthermore, wars are typically declared in a bear markets, not near all-time highs.

Therefore, there is a very high likelihood that no strike will happen against Syria, & markets

will rise till next earnings period with intermittent periods of sideways action.

Critical Level: Close below 1640 (Friday’s low).

In retrospect, all indices followed this road-map except for DJIA. DJIA had issues with re-configuration of its components.

September had 4 turn dates (2 major and 2 minor):

TURN WINDOW (AUG 30 +/- 4 DAYS): Marked the Bottom at 1628

TURN WINDOW (SEPT 10 +/- 4 DAYS): Marked the top

TURN WINDOW (SEPT 27 +/- 4 DAYS): Marked the bottom for re-entry purposes in Russell 2000/Nasdaq

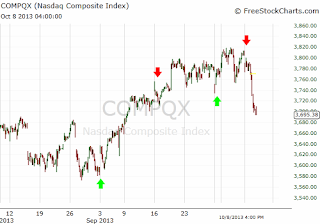

TURN WINDOW (OCT 7 +/- 4 DAYS): Marked the Top in Russell 2000 and Nasdaq

Yesterday's decline was the sharpest decline that we have seen in a while!!

Now the question is, when will this decline end. The answer will be based on the IPM Model Turn Date & the next IPM Turn window status (Top/Bottom) in conjunction with Market Matrix analysis.

Tuesday, October 8, 2013

Market Decline Update!

So we have seen the market top per IPM Model top date (scenario 2), as mentioned in the last blog post. Today's decline is broad based and ranges from Russell 2000 to Nasdaq. Market top took place within the current IPM turn window (Oct 7, 2013), and during this top date SP500 & DJIA put in a lower high.

Now the question is when is the market going to bottom & has the trend changed? And is this time to go short?

According to IPM Trading model:

Short Trade in an Uptrend = If next IPM Turn window is a bottom. If next turn window is schedule to be a top then no trade

IPM Model update will be sent over the coming week, and will highlight the next IPM turn date & whether it will be a top or bottom. I will try to send it out earlier!

Please note that bottoming signs have started to appear, and its possible that market might soon bottom with the earnings season / resolution of the Debt ceiling issue. We will use IPM trading model and the associated proprietary triggers to enter the long trade.

Sunday, October 6, 2013

Sideways Gyrations Continue!

With no clear message from the government to clarify the confusion related to Government Shutdown and Debt Limit, sideways market action continues. Futures are gaping down, but who knows by the time market opens Monday market, they might have reduced the gap down to zero.

In any case, at this point recent correction has lasted more than what was expected, and the buy signals are more than what were expected few days ago. This means that there is a higher potential of us reaching a significant bottom. However, since approaching IPM model is supposed to be a top, one of the following 2 scenarios might play out:

1- Market bottoms soon, starts a sharp rally. Pauses for few a days and then continues its rise

2- Market tops soon, and will decline sharply. Since DJIA has already declined sharply, topping scenario will best suited for Nasdaq and Russell 2000 and DJT.

In any case, I am writing this from JFK airport and will try to keep the blog updated while travelling abroad.

In any case, at this point recent correction has lasted more than what was expected, and the buy signals are more than what were expected few days ago. This means that there is a higher potential of us reaching a significant bottom. However, since approaching IPM model is supposed to be a top, one of the following 2 scenarios might play out:

1- Market bottoms soon, starts a sharp rally. Pauses for few a days and then continues its rise

2- Market tops soon, and will decline sharply. Since DJIA has already declined sharply, topping scenario will best suited for Nasdaq and Russell 2000 and DJT.

In any case, I am writing this from JFK airport and will try to keep the blog updated while travelling abroad.

Thursday, October 3, 2013

Another Decline But Why Such Disorder??

So today markets declined yet again, it can be attributed to president's panic button or to relentless bickering in D.C. In any case, market was down sharply in the morning. Although it recouped some of the losses by the end of the day, it still ended sharply in red.

There are two interesting aspects of this decline:

1- Except for DJIA, there is no order in the decline. Market is going up and down, with some indices near the highs while others near the bottom of the range. This kind of behavior is not consistent with a start of a strong down trend.

DJIA is showing a sharp decline since September 18 peak.

Russell 2000 is showing sideways market action since September 18.

Cumulatively there is nothing impulsive about these three markets and their declines, which suggests that we should consider this decline as a correction within a primary up-trend.

2- Over the last 2-3 days, we have seen panic coming back into the market. Sentiment surveys have started to show less optimism. Moreover, we have also received 2 buy signals from VIX and NYMO indicators. Therefore, this is suggesting that market correction is approaching an end.

Based on this analysis in conjunction with the IPM turn window, it is possible that market might be setting up for a stronger rally than what we had anticipated 1 week ago. If DJIA breaks below August lows then rally scenario will take a back seat.

There are two interesting aspects of this decline:

1- Except for DJIA, there is no order in the decline. Market is going up and down, with some indices near the highs while others near the bottom of the range. This kind of behavior is not consistent with a start of a strong down trend.

DJIA is showing a sharp decline since September 18 peak.

Russell 2000 is showing sideways market action since September 18.

SP500 is showing a sideways to down action since Sept 18 peak.

Cumulatively there is nothing impulsive about these three markets and their declines, which suggests that we should consider this decline as a correction within a primary up-trend.

2- Over the last 2-3 days, we have seen panic coming back into the market. Sentiment surveys have started to show less optimism. Moreover, we have also received 2 buy signals from VIX and NYMO indicators. Therefore, this is suggesting that market correction is approaching an end.

Based on this analysis in conjunction with the IPM turn window, it is possible that market might be setting up for a stronger rally than what we had anticipated 1 week ago. If DJIA breaks below August lows then rally scenario will take a back seat.

Wednesday, October 2, 2013

Obama Says That Wall St. Should Be Worried!! Should You Be?

After a long time, we have witnessed something amazing today: President of the world's only super power saying that Wall Street and investors should be worried about the prospects of the economy because politicians in the congress cannot get their act together.

http://www.cnbc.com/id/101081257

First, this kind of statement coming from a president does not make sense. Secondly, will it really impact the financial markets??

The answer for the time being is NO!! Markets like to fool the majority, as we have said multiple time on this blog. Political uncertainty is the perfect tool to make people distrust the economy for the time being. As this distrust increases, market will start climbing the Wall of Worry built on the foundation of political discord.

Overall, market remains in an uptrend. Following chart shows a clearly impulsive rise from August 30 bottom (IPM Model Bottom Date) to Sept 18 Top (IPM Model minor turn date). Since topping on Sept 18, market has declined in a choppy formation and has corrected 50% of the rise. This suggests that the market might have just completed a correction phase, and it is ready for another leg higher.

As long as 1675 is held, benefit of the doubt will go to the Bulls and we should expect further upside. Going long makes even more sense right now because this is the most difficult trade in the face government shutdown and political bickering in D.C.

Note: Next IPM Model turn date has been emailed to subscribers. IPM Model turn date can be used to time market entry and exit points.

http://www.cnbc.com/id/101081257

First, this kind of statement coming from a president does not make sense. Secondly, will it really impact the financial markets??

The answer for the time being is NO!! Markets like to fool the majority, as we have said multiple time on this blog. Political uncertainty is the perfect tool to make people distrust the economy for the time being. As this distrust increases, market will start climbing the Wall of Worry built on the foundation of political discord.

Overall, market remains in an uptrend. Following chart shows a clearly impulsive rise from August 30 bottom (IPM Model Bottom Date) to Sept 18 Top (IPM Model minor turn date). Since topping on Sept 18, market has declined in a choppy formation and has corrected 50% of the rise. This suggests that the market might have just completed a correction phase, and it is ready for another leg higher.

As long as 1675 is held, benefit of the doubt will go to the Bulls and we should expect further upside. Going long makes even more sense right now because this is the most difficult trade in the face government shutdown and political bickering in D.C.

Note: Next IPM Model turn date has been emailed to subscribers. IPM Model turn date can be used to time market entry and exit points.

IPM Model Update Emailed

IPM Model update has been emailed to subscribers.

Extract from IPM Update:

"In the last update it was stated that “There were three turn windows, and therefore, one should be careful.” It also mentioned that “there is a high probability of continued market rise till October 2013."

Please note that IPM Model bottom date was August 30, and the market bottomed on August 30 @ 1628 and rose to 1730 on Sept 18 i.e. ~100 point rise in less than 3 weeks.

Extract from IPM Update:

"In the last update it was stated that “There were three turn windows, and therefore, one should be careful.” It also mentioned that “there is a high probability of continued market rise till October 2013."

At that time no one believed in a sustained rally because of: Fed’s tapering decision, Fed’s new chairman decision, Syria military action, geo-political uncertainty, debt-ceiling debate, sluggish housing market, & rising interest rates.

Please note that IPM Model bottom date was August 30, and the market bottomed on August 30 @ 1628 and rose to 1730 on Sept 18 i.e. ~100 point rise in less than 3 weeks.

This is how market deceives the majority. Market is very clever!!

Tuesday, October 1, 2013

Government Shutdown (as Predicted) and Plan of Action

Two weeks ago, right after Fed's unexpected decision to hold-off on tapering, following was written at the blog:

"I think Federal Reserves' was looking ahead and they saw a real policy of a government shutdown in October, along with another long-drawn battle on debt-limit increase. That is why, they preemptive these political uncertainties by giving another doze of steroids to the market so that the impact of political stalemate does not ripple through the stock market, and consequently does not derail the nascent economic recovery.

As far as the political stalemate is concerned, this time it will be bad! On all previous occasions politicians started working on the debt-ceiling / government shutdown issues at least ~2 months in advance, with media shouting about this possibility ~3 months in advance. For example, in 2011 debt-ceiling was being discussed in the media in April/May time frame, months before the actual stock market decline in August.

But this time, it is different. Today, was the first time I saw something on the news about a potential government shut-down in a financial news outlet. This means that lawmakers are not taking this shut-down seriously with only 2 weeks left to the the shutdown. This will be followed by debt-ceiling debate, which needs to be settled in less than a month. And finally, since Republican lawmakers have been burnt by sequestration earlier this year, it is highly unlikely they will easily cooperate on this issue."

It came true tonight! But the above analysis does not say how the market should or will react. In fact, as per IPM model we defined the market trajectory in August 25 and Sept 8, 2013 updates. Market has been following the script very precisely.

So the question is what will happen next? There is a very high potential that market will rally into the next IPM model top date. In other words, it will rise in the face of political uncertainty, because this will be the least obvious trade. However, this rise will be capped by the IPM Model top date.

IPM Model update with detailed market analysis will be sent out to subscribers today!

"I think Federal Reserves' was looking ahead and they saw a real policy of a government shutdown in October, along with another long-drawn battle on debt-limit increase. That is why, they preemptive these political uncertainties by giving another doze of steroids to the market so that the impact of political stalemate does not ripple through the stock market, and consequently does not derail the nascent economic recovery.

As far as the political stalemate is concerned, this time it will be bad! On all previous occasions politicians started working on the debt-ceiling / government shutdown issues at least ~2 months in advance, with media shouting about this possibility ~3 months in advance. For example, in 2011 debt-ceiling was being discussed in the media in April/May time frame, months before the actual stock market decline in August.

But this time, it is different. Today, was the first time I saw something on the news about a potential government shut-down in a financial news outlet. This means that lawmakers are not taking this shut-down seriously with only 2 weeks left to the the shutdown. This will be followed by debt-ceiling debate, which needs to be settled in less than a month. And finally, since Republican lawmakers have been burnt by sequestration earlier this year, it is highly unlikely they will easily cooperate on this issue."

It came true tonight! But the above analysis does not say how the market should or will react. In fact, as per IPM model we defined the market trajectory in August 25 and Sept 8, 2013 updates. Market has been following the script very precisely.

So the question is what will happen next? There is a very high potential that market will rally into the next IPM model top date. In other words, it will rise in the face of political uncertainty, because this will be the least obvious trade. However, this rise will be capped by the IPM Model top date.

IPM Model update with detailed market analysis will be sent out to subscribers today!

Subscribe to:

Posts (Atom)