Recap

First Quarter of 2017 was very eventful. It started with an overbought market, which continued to gyrate with new president coming into the office and confusing Executive Orders. While all of this happened in January, earnings started coming in better than expected and propelled the market to new highs in February.

After topping on March 1, within IPM turn window, market declined for rest of March. Many reasons were given for this decline including overbought market, high valuations, sentiment, potential for unfulfilled presidential promises and geo-political turmoil. Sadly, this wasn't something new. These kind of events happen all the time, making investing an arduous task.

Now the question is how can someone properly and profitably navigate through such tumultuous markets, while maintaining one's composure. That's why we created strategies that don't depend on market news, rather take into account underlying market currents to make investment decisions. This reduces transaction cost, dampens volatility and increases consistent results.

We are currently running two strategies. Goal of both portfolio is to generate absolute, uncorrelated returns for long-term growth. These are:

Conservative - Enhanced PSB (Green )

Conservative strategy went live in 2016. It returned 6.8% (excluding fees) against 6.1% return of SP500 total returns including dividends.

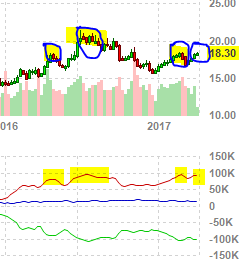

Following chart shows the cumulative performance of Conservative portfolio since inception. Strategy returned 19.8% (excluding fees) vs SP500 total return of 19.8%. In 2016, conservative strategy outperformed SP500 12.2% vs 12%.

Aggressive Strategy - Aggressive Enhanced PSB (Orange)

Aggressive strategy went live in 2017. It returned 15.6% (excluding fees) against 6.1% return of SP500 total returns including dividends.

Since this strategy went live in 2017, Q1'2017 performance of 15.6% also shows the since inception performance of the Aggressive Strategy.

Although past performance doesn't guarantee future results, Q2'2017 performance remains very robust for both strategies.

The best aspect of these strategies is that they enables the investor to concentrate on the work that is more important in life than losing sleep on investments while looking at news all the day because we do the research and invest using proprietary algorithms and valuation models.

These strategies are open for investment. Please feel free to contact via subscription.ust@gmail.com for details. These strategies can be implemented via managed account setup through a Registered Investment Advisor. Please contact us for details. You can also sign-up for free email updates below:

First Quarter of 2017 was very eventful. It started with an overbought market, which continued to gyrate with new president coming into the office and confusing Executive Orders. While all of this happened in January, earnings started coming in better than expected and propelled the market to new highs in February.

After topping on March 1, within IPM turn window, market declined for rest of March. Many reasons were given for this decline including overbought market, high valuations, sentiment, potential for unfulfilled presidential promises and geo-political turmoil. Sadly, this wasn't something new. These kind of events happen all the time, making investing an arduous task.

Now the question is how can someone properly and profitably navigate through such tumultuous markets, while maintaining one's composure. That's why we created strategies that don't depend on market news, rather take into account underlying market currents to make investment decisions. This reduces transaction cost, dampens volatility and increases consistent results.

We are currently running two strategies. Goal of both portfolio is to generate absolute, uncorrelated returns for long-term growth. These are:

- Conservative: Suitable for retirement accounts and risk-averse investors

- Aggressive: Suitable for risk taking investors, with longer-term invest goals

Conservative - Enhanced PSB (Green )

Conservative strategy went live in 2016. It returned 6.8% (excluding fees) against 6.1% return of SP500 total returns including dividends.

Following chart shows the cumulative performance of Conservative portfolio since inception. Strategy returned 19.8% (excluding fees) vs SP500 total return of 19.8%. In 2016, conservative strategy outperformed SP500 12.2% vs 12%.

Aggressive Strategy - Aggressive Enhanced PSB (Orange)

Aggressive strategy went live in 2017. It returned 15.6% (excluding fees) against 6.1% return of SP500 total returns including dividends.

Although past performance doesn't guarantee future results, Q2'2017 performance remains very robust for both strategies.

The best aspect of these strategies is that they enables the investor to concentrate on the work that is more important in life than losing sleep on investments while looking at news all the day because we do the research and invest using proprietary algorithms and valuation models.

These strategies are open for investment. Please feel free to contact via subscription.ust@gmail.com for details. These strategies can be implemented via managed account setup through a Registered Investment Advisor. Please contact us for details. You can also sign-up for free email updates below: