Today's market action was very scary. Since last week to today's lows, markets decline over 10%. This decline wiped out more than ~$1.5 Trillion in wealth from the stock market.

If you had looked at the news today, it was horrific. There was live coverage on the decline even on channels like CNN. I have received several calls from investors trying to figure out if they should enter the market or not. And how are the proprietary models of Understand, Survive and Thrive, reading into this market.

I would like to start by saying that panicking will not help!!!

DJIA completed a head and shoulders pattern at the top, which was not noted in the financial media. This kind of development suggested that we should expect this head and shoulders pattern to play out. However, I did not expect a crash like scenario.

Now that we have seen the flash crash type of event, the big question is how should one proceed. Should we buy the dip or use the rally to sell-out of equities. In order to objectively analyze these two options, lets look at three Bull/Bear market indicators that we have used to great success.

In conclusion, we should expect a sharp rally over the next few days. Otherwise, markets will enter a prolonged bear market, which yield curves inverting over the next few months.

If you had looked at the news today, it was horrific. There was live coverage on the decline even on channels like CNN. I have received several calls from investors trying to figure out if they should enter the market or not. And how are the proprietary models of Understand, Survive and Thrive, reading into this market.

I would like to start by saying that panicking will not help!!!

DJIA completed a head and shoulders pattern at the top, which was not noted in the financial media. This kind of development suggested that we should expect this head and shoulders pattern to play out. However, I did not expect a crash like scenario.

Now that we have seen the flash crash type of event, the big question is how should one proceed. Should we buy the dip or use the rally to sell-out of equities. In order to objectively analyze these two options, lets look at three Bull/Bear market indicators that we have used to great success.

- Yield curve inversion: Historically, over the last 50 years no bear market has ensued without yield curve inversion (link). If that is the case, yield curve is not inverted yet and therefore, we should give benefit of doubt to the market

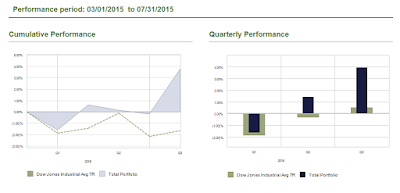

- Proprietary Bull/Bear indicator, using optimum Bull/Bear criteria, is calculated on a monthly basis. As of last calculation at the end of July, it was registering 70%, which is above the threshold of 65%. Although the indicator will be recalculated on Aug 31, persistent market decline can result in us entering a bear market. This would mean that we have several months of lower prices ahead. The true result will come out on September 1st and therefore, no decision of exiting longs will be made till that time

- Another very important Bull market indicator is still bullish which uses Global Dow as the proxy of global stock markets. It would need September data to declare whether we have entered a bear market or not.

In conclusion, we should expect a sharp rally over the next few days. Otherwise, markets will enter a prolonged bear market, which yield curves inverting over the next few months.