Last week was a positive week for the overall market. Blue chips gained some but Nasdaq gained a lot. Nasdaq is now within few points of all time high, which was set in 2000.

Although Nasdaq (the darling of 90s) is now approaching all-time highs after 15 years, many of the companies that were making higher highs in early 2000 are no where to be found in today's market. If one had invested in selected few companies, he would still be at a much lower level.

The story of Nasdaq taking 15 years to reach its all-time highs, teaches us two important lessons:

- Market can remain below a certain level for eons. Therefore, buy and hold might not be the best strategy

- Individual stocks are extremely hard to manage because of their individual unique profiles, company cultures and other aspects

Being said that, now the question arises how can one then beat the market and should one hire a money managers, with ton of market experience, to beat the market. Lets tackle both of these questions one by one:

Firstly, over the long-term (~20 years) only 1-2% of the money managers beat the market. This means that the probability of selecting a winning manager is .02. In other words, if you have the choice of investing money with 100 money managers, only 2 will be able to beat the market over the long-run. Furthermore, all of them will take money management fees. So should one invest with money managers with such low odds of success?

This observation gives credence to Warren Buffet's concept that its better to invest in low cost ETFs that follow the market and at least perform better than majority of the money managers because you will be closely following market's performance. But this method does not answer the question of how to beat the market. Although it is a difficult question to answer, it is a very good question to ask!!

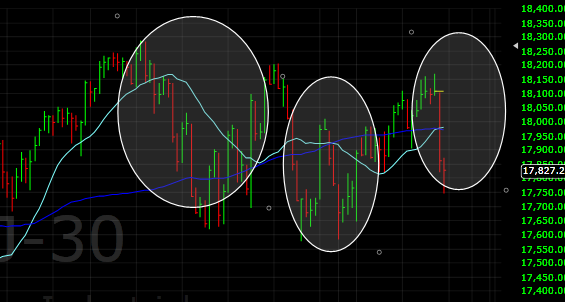

In order to beat the markets, one should buy good companies and ride them as long as they perform well. If they enter a bear market, one should start riding another well-performing company. Although this concept seems very simple, it is very difficult to implement. In order to effectively implement this concept one needs following 5 pieces of information:

- Which companies to invest in?

- Whether selected stock is in a bull or bear market?

- How much to invest in each position?

- When to exit a certain position?

- How to protect gains?

As you know Understand, Survive and Thrive has been performing market analysis over the past several years with the goal to optimize portfolio returns using objective techniques and algorithms to take out emotions from trading. We have recently tried to incorporate above mentioned 5 pieces into our model for long-term investing.