Last week saw an unprecedented referendum, with UK deciding to leave the European Union after 50+ years. As UK became the first country to ever leave the EU, global markets roiled with US DJIA declining over 600 points.

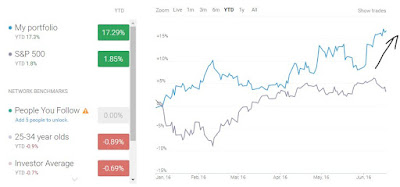

The interesting aspect of the referendum results was it was totally out of the blue. No one really expected this to happen. And as a result, a lot of investors were caught off-guard. On the contrary, UST's portfolio allocation algorithm saw a sharp rally (shown below).

YTD model portfolio is up 18.5%, while SP500 is up 0.72% after dividends. Furthermore, the positioning of current portfolio components gives it a Beta of -0.06 i.e. the returns are totally uncorrelated to the markets.

Allocation might change over the next few weeks, as new market data comes out. But overall, the model portfolio has handsomely beaten the market in 2016. A variant of this model portfolio, utilizing leverage and exotic asset classes, is up ~40% since March 2016. We will share results of the leverage portfolio after more data points are gathered.

The portfolio utilizes an algorithm that fuses together multiple market analysis strategies to define optimum portfolio allocation by assets. One of the key proprietary model is "Market Classification Algorithm." We will share the importance of Market Classification Algorithm in the next blog post.