Brexit fears continue. Market's declined last week with VIX spiking and generating a buy signal, which is being played out today with a sharp rally.

According to financial media, the catalyst for this rally is easing Brexit fears. However, Brexit is just one part of the equation. There are more fundamental issues with the economy, which people are ignoring. We will talk about these issues in the next few posts.

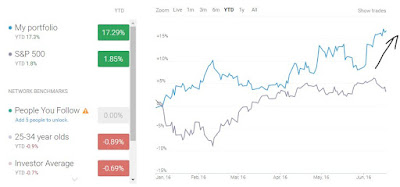

While the market and economy is now starting to face the reality and is under-performing, our prop portfolio is doing extremely well. As of June 17th, the model is up 17.30% based on real money performance tracked by OpenFolio (seen below).

This month's gain has triggered a 'Go to Cash' signal for a small portion of the portfolio.

Following are few interesting observations:

- Model rallied back sharply after May's decline

- Model's asset weighted Beta correlation to the market is -0.06, which means that the underlying portfolio components are not linked to the market performance.

- Model's internal risk management metrics allow us to capture gains and adjust portfolio in case of evident anomalies.

No comments:

Post a Comment

I would love to hear from you! Please leave your comment below!!