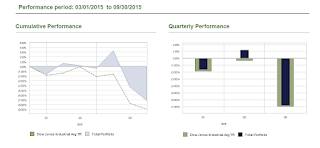

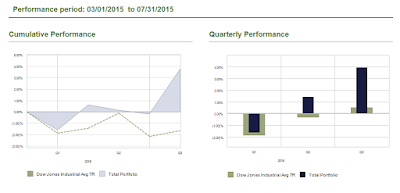

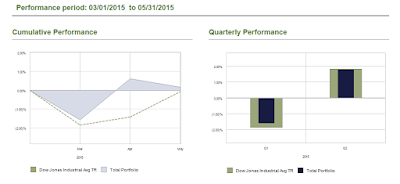

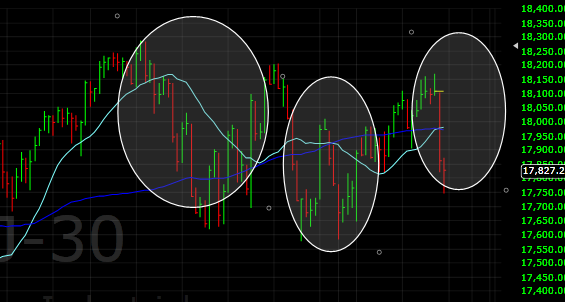

Market's decline on Friday was very sharp and was on top of Thursday 250+ point decline in $DJIA. This decline has brought the market to a critical support level in Nasdaq and $DJIA, while in other indices like Russell 2000 and $SPY this critical level has already been broken to the downside.

Downside break means that the near term trend has turned down. Although some technical analysts might take this decline as a trend change signal, at UST we have been suggesting that a sea change has already taken place in the stock markets in August.

Unfortunately, many market participants are still not seeing the bigger picture because they don't follow objective trend analysis. Instead, they follow the market events and try to gauge the markets response to these events. At Understand, Survive and Thrive, we have always used objective market analysis and statistical models to identify market trends and turn points.

In the last post (link), we analyze the significance of recent Federal Reserves action and suggested that although the Federal Reserves thinks that the economy is strong and they can raise rates, this rate increase could not only have negative consequences on the market but also could result in lower rates. Longer term rates are governed by the perception of the economy of market participants and if investors don't believe in the same story of strong fundamentals, they might keep on buying the bonds, resulting in lower bond yields and higher prices.

Although this concept does not make intuitive sense, it was evident in the last few days where the market went down and interest rates also went down even after Fed's rate hike.

We have already discussed the potential fundamental issues with the economy and how its depends on the perception. There are also several technical reasons behind rally in bond prices:

From socio-economic and sentiment perspectives, in anticipation of Fed's announcement many people jumped ship from the bonds and exited in great numbers. This could be interpreted as a potential contrarian buy signal for longer-term bonds.

Finally, as we have been saying for quite some time, bonds are in bull market for some time and will remain till model says otherwise. Therefore, we will find reasons for the bull market to continue which can be either due to economic weakness, technical rally or delay from Fed in raising rates further.

Please note that this analysis is only pertaining to high quality long-term bonds and not related to Junk bonds, which are linked to the economic activity. Weakness in economy would result in a decline in Junk bonds, as we have been witnessing over the past few months.

Downside break means that the near term trend has turned down. Although some technical analysts might take this decline as a trend change signal, at UST we have been suggesting that a sea change has already taken place in the stock markets in August.

Unfortunately, many market participants are still not seeing the bigger picture because they don't follow objective trend analysis. Instead, they follow the market events and try to gauge the markets response to these events. At Understand, Survive and Thrive, we have always used objective market analysis and statistical models to identify market trends and turn points.

In the last post (link), we analyze the significance of recent Federal Reserves action and suggested that although the Federal Reserves thinks that the economy is strong and they can raise rates, this rate increase could not only have negative consequences on the market but also could result in lower rates. Longer term rates are governed by the perception of the economy of market participants and if investors don't believe in the same story of strong fundamentals, they might keep on buying the bonds, resulting in lower bond yields and higher prices.

Although this concept does not make intuitive sense, it was evident in the last few days where the market went down and interest rates also went down even after Fed's rate hike.

We have already discussed the potential fundamental issues with the economy and how its depends on the perception. There are also several technical reasons behind rally in bond prices:

- Inverted Head and Shoulders Pattern

- Capital outflow from bond funds

- Proprietary trend indicator

From socio-economic and sentiment perspectives, in anticipation of Fed's announcement many people jumped ship from the bonds and exited in great numbers. This could be interpreted as a potential contrarian buy signal for longer-term bonds.

Finally, as we have been saying for quite some time, bonds are in bull market for some time and will remain till model says otherwise. Therefore, we will find reasons for the bull market to continue which can be either due to economic weakness, technical rally or delay from Fed in raising rates further.

Please note that this analysis is only pertaining to high quality long-term bonds and not related to Junk bonds, which are linked to the economic activity. Weakness in economy would result in a decline in Junk bonds, as we have been witnessing over the past few months.