Summary:

- Gold market Overview at the top of the post

- Positioning / Investment options at the bottom of the post

- Analysis: Short, Medium and Long-term analysis with rationale in the middle

Introduction

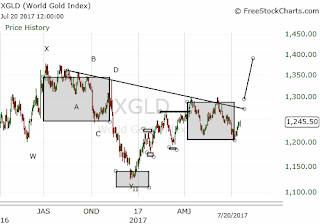

On April 4, 2017 we mentioned that the Gold rally could pause over here. At that point Gold was at 1263 and today its at 1245. Following chart shows the ~4 month sideways consolidation in Gold:

What happened to Gold was that it succumbed to excessive optimism among market participants and as a result wasn't able to muster enough strength or the wall of worry wasn't strong enough to allow Gold to climb beyond immediate resistance levels.

At the same time, stock markets around the world did pretty well, which dampened Gold's demand. As a result, sentiment turned extremely sour towards precious metals. for example:

- Daily sentiment Index reached: 10 out of 100

- Long Positions of major hedge funds reached lows not seen since late 2015

- Articles started coming out proclaiming much lower Gold prices and Bitcoin being the new Gold

Near -term: Since July 11th Gold has been stair-stepping higher without any major move, which is good because its moving under the radar. Secondly, it is tracing out a sequence of 1s and 2s, which can lead to a sharp move higher in wave 3 of 3.

Medium Term: While Gold and Gold stocks prepare for acceleration on the short-term time frame, they are also positioned very well for a rally in medium term. Because at this time frame, Gold also completed a sequences of 1s and 2s. Even though following chart shows Gold stocks, bullish case for Gold is similar if not better.

Longer-term: Gold is tracing out an inverted Head and Shoulders pattern. This pattern, once broken can lead to 1400 price. Important thing to note is that this price target might will not be achieved in one day but will reach there over time.

Rationale: There are many reasons that can propel Gold to higher levels some of these include:

- Potential correction in Stocks and Gold acting as the safety trade

- Potential increase in geo-political tensions

- Continuous weakness in US Dollar Index, which was one of the big trades at the start of the year but we mentioned in February on twitter (@survive_thrive) that this US Dollar rally might be over, so one should look for alternatives. We will discuss US Dollar index in greater detail in another post.

Positioning

Markets are at a critical juncture. However, knowing that is one thing and acting on this information is totally different in our experience. We mentioned following big moves on this blog/twitter in 2017 but doubt if effective trading was performed around this analysis:

- March Top

- April Top in Gold

- April Bottom in Stocks

- Emerging Market buy in February

- Early July bottom in Nasdaq

- ...

At this critical time, we are using proprietary models to expose clients to positions that have the highest success probability. Our strategies have generated consistent returns, while taking advantage of new market opportunities and minimizing existing risk. We provide Absolute Return Hedge Fund like strategies through Managed Accounts. Performance - H1 2017

Contact

- Any investment / trading questions: Twitter (@survive_thrive)

- Free e-mail subscription: Click on the button below and select "Free E-mail"

- Invest with us: Click on the button below and select last Investment Option and a Registered Investment Advisor will get in touch with you.

Trading in gold is great way to make good profit ratio on your investments. Recent trading volumes are propelling the company to its best quarter ever in terms of revenues and profits. In the gold trading pits, economic uncertainties are taking a back seat to uncertainties of a different nature these days. Stay align with the market by following the gold signal providers and make sure to get reasonable profits on your investments.

ReplyDelete