Today's sharp rally wraps up an amazing 5 day period in the markets. Today, Nasdaq 100 closed within 0.4% of all-time highs. It feels like a stealth rally, especially at a time when the entire financial media started proclaiming end of the bull market or a sharp decline, after last Friday's decline.

It has been a period through which we can learn a lot of investment lessons and become better traders. For Example:

How it started!

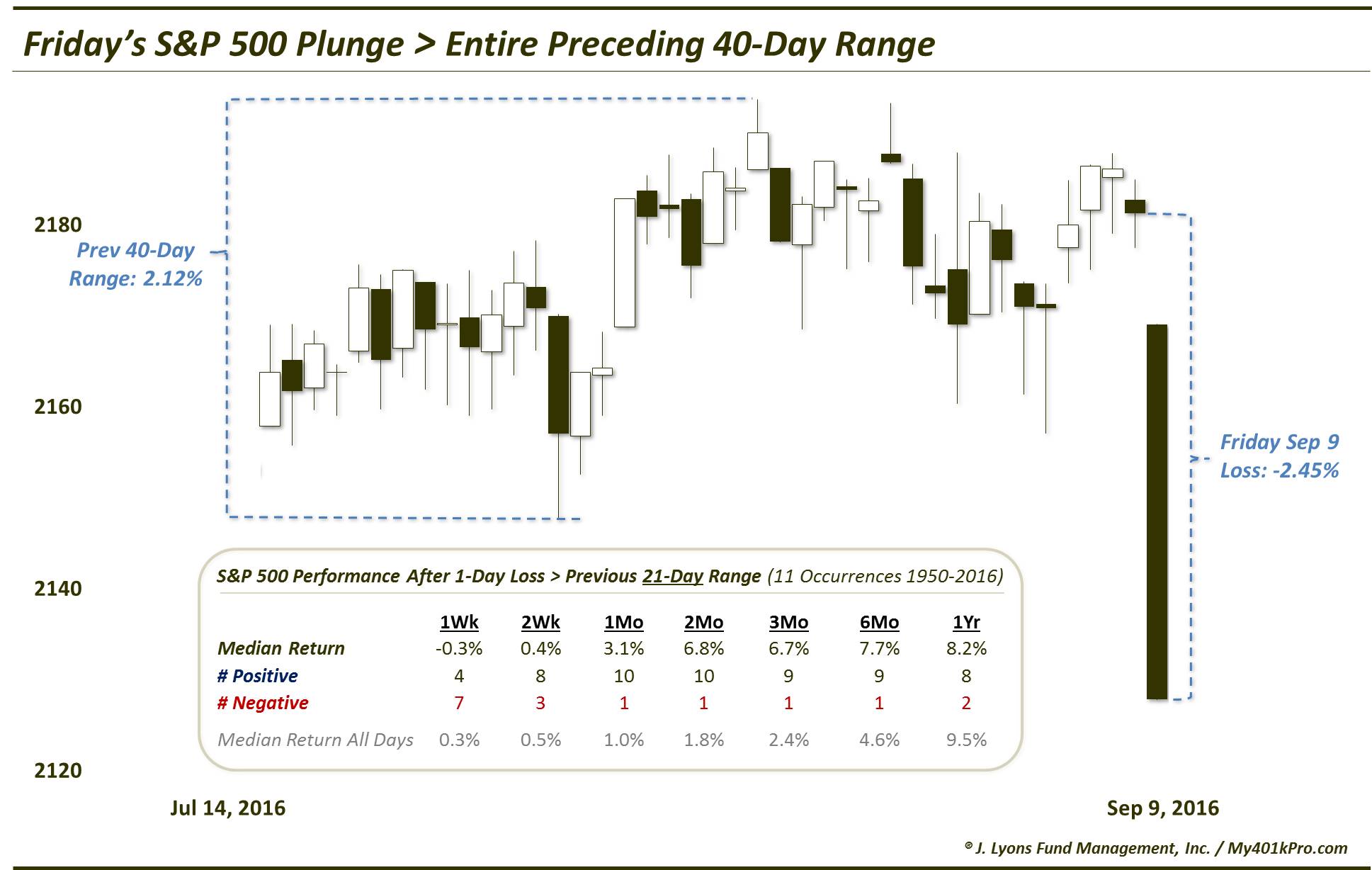

Last 5 days have been nothing short of amazing for the markets. On Friday, September 9, markets declined substantially. The decline was so significant that trading range of 40 days was covered in one trading session.

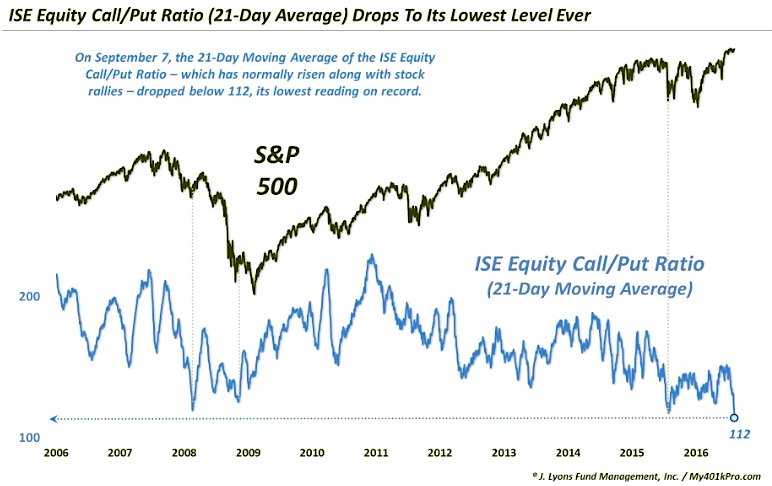

This decline was quite a departure from the dog days of Summer, where market set a record in reduced volatility. By some measures, the volatility was lowest in history. (Charts courtesy of Dana Lyons)

Although many knew that this kind of action is unsustainable, the decline that followed took many by surprise. While everyone was talking about a decline and even we were expecting a decline to shake-out the loose hands, most amusing part was the justification for this decline.

You could see reasons from Fed to emerging markets unwinding, and from valuations to sentiment based complacency. Although all of these reasons are very valid reasons, one needs to thing about these in the context of the market.

Market Trend

According to Market Classification Matrix, a proprietary indicator that uses internal strength indicators that tell us about the strength of the market, we were in a uptrend. And therefore, instead of selling or panicking, we stayed long and kept our cool. No longs were exited.

Our proprietary trading model kept it's long positions. And as September 9th progressed, we realized that this sell-off was generating several buy signals. We will discuss some of the buy signals and the reasons why we think we are just starting the next rally phase, in the next posts. Even though the decline did not result in an immediate bottom for major indices, we saw a sharp rally on Monday after morning decline, which was followed by another two declines on Tuesday and Wednesday.

But the bottom line is that many people panicked while trend remained up. There were very few people who took advantage of the market when it was declining.

It has been a period through which we can learn a lot of investment lessons and become better traders. For Example:

- Do not panic and stay with the trend

- Market will continue to deliver sharp declines in a bull-market and sharp rallies in bear markets to push market participants on the sidelines or in the wrong direction

- Always remain aligned with the direction of the trend, no matter what the headlines are

How it started!

Last 5 days have been nothing short of amazing for the markets. On Friday, September 9, markets declined substantially. The decline was so significant that trading range of 40 days was covered in one trading session.

This decline was quite a departure from the dog days of Summer, where market set a record in reduced volatility. By some measures, the volatility was lowest in history. (Charts courtesy of Dana Lyons)

Although many knew that this kind of action is unsustainable, the decline that followed took many by surprise. While everyone was talking about a decline and even we were expecting a decline to shake-out the loose hands, most amusing part was the justification for this decline.

You could see reasons from Fed to emerging markets unwinding, and from valuations to sentiment based complacency. Although all of these reasons are very valid reasons, one needs to thing about these in the context of the market.

Market Trend

According to Market Classification Matrix, a proprietary indicator that uses internal strength indicators that tell us about the strength of the market, we were in a uptrend. And therefore, instead of selling or panicking, we stayed long and kept our cool. No longs were exited.

Our proprietary trading model kept it's long positions. And as September 9th progressed, we realized that this sell-off was generating several buy signals. We will discuss some of the buy signals and the reasons why we think we are just starting the next rally phase, in the next posts. Even though the decline did not result in an immediate bottom for major indices, we saw a sharp rally on Monday after morning decline, which was followed by another two declines on Tuesday and Wednesday.

But the bottom line is that many people panicked while trend remained up. There were very few people who took advantage of the market when it was declining.

No comments:

Post a Comment

I would love to hear from you! Please leave your comment below!!