As markets have rallied over the last few days, Euro has declined. This behavior has been an ominous signal in the past. One key reason behind this sudden decline in Euro and surge in US Dollar is that the Federal Reserves' meeting minutes (yesterday) suggested that "Fed is running out of bullets." (MarketWatch)

This news headline clearly shows how dire the situation might be i.e. If Fed cannot save us then who can? Add this to Fiscal Cliff - Part 2, which we will be seeing in the congress over the next 2 months over the debt limit issue, and we get a perfect "Headline based" recipe for a sharp market decline.

This is exactly what is evident on the internet, as many blog writers, individual investors and brokerage houses are trying to fade this rally, based on the above mentioned socio-economic risks. However, a detailed market structural analysis suggests otherwise.

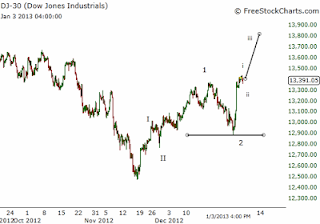

Based on experience, Elliott Waves evolve over time. Since this evolution can take different shapes, it is very important to know the time-wave relationship. In this regard, the following preferred count was presented on the Blog for DJIA. This was the preferred count because it aligned with the IPM Model's turn dates.

|

| Predicted |

|

| Actual |

Above chart shows the market structure, as it unfolded in December. Therefore, the 1,2 - 1,2 structure was validated by the market action.

Today's Elliott Wave Structure

Since the 1,2 - 1,2 market structure was validated by the market, we will keep on analyzing this structure as our primary Market layout. Following chart shows DJIA & SP500 structures with (I,II - 1,2 - i,ii) count on them. According to this count, market should continue to rally in the near term with brief pauses here and there.

If this structure holds, it would suggest that we are in a 3 of 3 wave. These waves tend to be the strongest of all. Therefore, market should rally stubbornly after completing the near-term 2nd wave. Please note that recent rally did result in sharp declines in VIX and other sentiment based indicators, therefore, markets might need a brief pause before resumption (which might have been completed by yesterday's decline).

The 3 of 3 market case flows well with the next IPM Turn date and the political uncertainty surrounding the markets (mentioned at the start of this post). Markets typically do well when there is geo-political uncertainty. For example, even with a fill-blown Euro crisis in the Europe, German Dax index had its best year in 2012 since 2003 i.e. up 30%.

In order for this structure to remain valid, market should not violate the following levels:

SP500: 1399

DJIA: 12,887

Although there is one other alternative wave structure (diagonal pattern), but it is such a low probability in the current backdrop of sentiment, IPM Turn date and market internals, that it will not be shared with readers to avoid confusion.

Conclusion:

We are in an uptrend. 3 of 3 waves are very strong waves, and can result in persistent market rise. Next area of the market pause will be at the upcoming IPM Turn date. Market should stay above the critical levels stated above. Global markets remain in a bull market, and we can soon see another rally leg. In a bull market, surprises are typically to the upside.

Subscription

If interested in IPM Model Subscription, please fill out the form below. Next IPM Model update will be sent to Subscribers on Sunday (1/6/2013). IPM Subscription will be closed after a limited number of subscribers to maintains models validity. Model Performance

As the IPM forecasts the direction of the S&P500, can readers suggest several investment vehicles to take advantage of up AND down moves? As a new subscriber not used to short term trading, I'd be interested to hear how others profit. How much time does it take to monitor (I don't have much!). How does this trading fit into an overall allocation model? Thanks.

ReplyDeleteWhat do you mean investment vehicles? bonds, stocks, international? I've been trading mostly ETF's lately. I trade S&P ETF's and others. I haven't short traded lately either. I trade the intermediate directions (up or down). IF you don't have much time, short term trading may not be for you. Intermidiate or lonng term is better. However, long term trading is harder to predict.

ReplyDeleteJOseph

Latest IPM Model update has been emailed to subscribers.

ReplyDeleteCome on S$P! Break that resistance level!! We are at 1471 now!! Let's go!!! hahahah

ReplyDeleteJOseph

Market continues to defy the odds. People who bought the lows are sitting happy, all others are panicking!

ReplyDelete1- Some are saying market is too high and needs to pull back. While waiting for the pullback, market is leaving them behind.

2- Some are buying in panic because market is going up.

So far we have not seen a sell signal, but we are close. As we approach the next IPM turn window, technical indicators based sell signals will be the first sign that we are about to see a correction. However, these signals might occur after another buying burst i.e. 2 day sharp rally. We will see how things work out tomorrow as we Wells Fargo, announces its financial results.

P.S. You can blame my Flu for infrequent blog posts.

Thanks

I'm hoping we can break SP 1472 before the IPM.

ReplyDeleteCome on S$P! Break that resistance level!! Not again!! We are at 1471 now!! Let's go!!! Now!!

ReplyDeleteBroke resistance! Here we go guys! Hold on your horses!!

ReplyDeleteNow is the time to get wary. This rally could last for a few days, but there are now signs of a correction propping up. Sentiment is now elevated, ipm window is at hand, the only thing missing is a sell signal. If not already in the market, there will be an even better time to buy the stocks in February.

ReplyDeleteAgree Anonymous.

ReplyDeleteWary is right. I was in the market since the beginning of December and I got out yesterday. It is easier to take less profit and let the riskier folks determine the top than it is to hang on for too long and take a loss and try to recover. We are in the back half of the IPM turn window, market sentiment seems too high, and short covering can only push the market so much higher. A quick turn around could reap havoc. Sorry to be playing it so safe, but I'd rather have the bird in the hand and wait to buy back in with a better trading opportunity. Be careful out there, Brad

ReplyDeleteDid the same here. Got out of market yesterday. Played a little on short side for market pull back.

ReplyDelete