As stated yesterday, the stock market was setting up for a strong rally. This prediction was made when the DJIA futures were down more than 100 points. Thereafter, markets turned on a dime and rose more than 350 points. This kind of analysis not only proves the reliability and ability of Understand, Survive and Thrive's market analysis techniques, but also forces us to thank God as such accuracy is only possible through God's guidance.

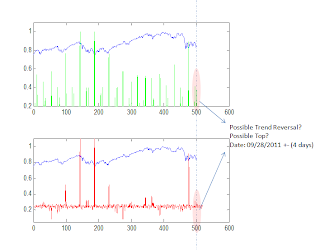

For the last two months, UST has been asserting that markets are in a downtrend and that one should pick the tops to short the market rather than picking the bottoms. Based on this hypothesis, it was mentioned that an Inflection Point Model turn window is fast approaching. This turn date is very critical because financial markets, which are already badly bruised by the debt crises, could turn for the worse. In order to further refine the turn date, we re-ran the Inflection Point Model. The program output is given below:

ANALYSIS

According to the two models, the next turn date is scheduled for September 28, 2011 (+/- 4 days). This means that markets are already in the turn window, and can turn on any day.

Therefore, one should be very careful and be on the lookout for a trend reversal before going short.

At the next turn date, both models are showing a potential turn, thus amplifying turn possibility. To our amazement, there are two turn dates very close to one another. First turn occurred on September 22, 2011 giving way to 7.7% market decline in less than 3 days. Now the second turn date and recent market action suggests that we might see a double top, or a sharp rally to complete 2nd wave, before starting the 3rd (strongest) down leg.

Interestingly, this time frame also coincides with elections in the European Union to support or negate the European Bailout package. Hence, this week can prove to be a very significant week in terms of global macro-economic events. At this point one should keep in mind that 2008 crash actually started when the U.S. Congress finally passed the bailout package in September 2008 (shown on right). A similar announcement from the EU nations could mark the top of current upward correction (If the uptrend remains intact for the next couple of days).

Interestingly, this time frame also coincides with elections in the European Union to support or negate the European Bailout package. Hence, this week can prove to be a very significant week in terms of global macro-economic events. At this point one should keep in mind that 2008 crash actually started when the U.S. Congress finally passed the bailout package in September 2008 (shown on right). A similar announcement from the EU nations could mark the top of current upward correction (If the uptrend remains intact for the next couple of days). Note: Whenever I see such fundamental developments in conjunction with the Inflection Point Model turn dates, I ask myself: How does IPM know about an impending fundamental event?

Since we are in a bear market, the primary goal of investors should be to preserve capital as sharp rallies can result in significant losses. Hence, we will intently and safely wait on the sidelines for the turn window and the Trading Algorithm signal. In the next few days, Trading Algorithm might generate a Short Sell Signal - we will trade the signal when it is generated and not our hypothesis.

MARKET PROBABILISTIC ANALYSIS

Since trading is a probabilistic endeavor, one should always assign each potential scenario a probability based on historical data and then calculate expected profitability of any trade before committing capital. Right now, there are three possible scenarios with regards to the upcoming turn date:

1- Market tops during the turn window - Highest Probability (0.7)

This is the highest probability scenario because of EW structure, bear market, historical precedence.

This is the highest probability scenario because of EW structure, bear market, historical precedence.

2- Market pauses (sideways movement), Resumes uptrend - Low Probability (0.3)

This is a less likely scenario because we are in a downtrend, and if the market continues to rise through the turn window then it would most likely suggest that the bear market has ended. In order for this scenario to materialize, market (SP500) should break above 1220 level. Since this is a low probability scenario, we will deal with it if current market structure changes.

This is a less likely scenario because we are in a downtrend, and if the market continues to rise through the turn window then it would most likely suggest that the bear market has ended. In order for this scenario to materialize, market (SP500) should break above 1220 level. Since this is a low probability scenario, we will deal with it if current market structure changes.

In any case, Trading Algorithm will continuously evaluate the market structure and will undertake the trade with highest success probability and highest expected profitability.

VERY INTERESTING OBSERVATION

When running the IPM, we extended the data array to get an idea of potential future market turns. What we found was really fascinating! Current Inflection Point Model behavior is similar to the July/August time frame i.e. the next turn date is far away from September 28, 2011 turn date. This kind of behavior demands closer scrutiny through Market Structure, Market Matrix and other proprietary market analysis techniques.

UST team will continuously evaluate the market behavior to decipher the future market direction and to pick a potentially significant Market bottom in October/November time frame. As we enter October, UST team will re-run the Inflection Point Model to further narrow down the next turn window.

Note: If you have not received the subscription invite, contact us at: subscription.ust@gmail.com

No comments:

Post a Comment

I would love to hear from you! Please leave your comment below!!