This decline has resulted in multiple bond indicators turning bullish i.e. sentiment turning so pessimistic that it is now bullish. Three widely followed sentiment indicator readings are given below:

1- Hulbert Sentiment Index:

The blue line below represents bond yields. Bond yields move in the opposite direction to the bond prices. Red line indicates the sentiment towards bonds. At this point, it appears that the sentiment is as negative as we have seen in ~2 years. Therefore, there is a good wall of worry to support a bond rally.

2- Bund Sentiment

Bunds are German bonds. Bunds were among the bonds that went into negative yield territory. While they were negative, everyone was bullish on the future of Bunds. However, very few realized that it was more close to the end of the Bunds rise. On the contrary, right now investors are very bearish on Bunds. This suggests that this a good time to increase exposure to bonds

3- Bond Sentiment NDR indicator

According to NDR services, bond sentiment is now extremely pessimistic, which supports the argument that the Bond decline is over-extended and we should anticipate a rise in Bond prices:

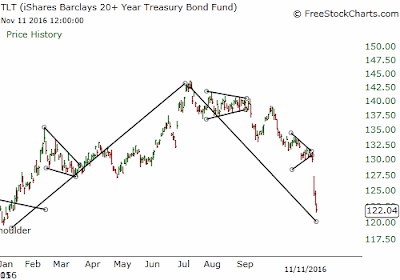

Bond Market Trend

While we are seeing some very pessimistic sentiment readings, these are coming at a time when the Bond market remains in a bull market according to our proprietary Market Classification Model. Therefore, the prudent trade right now would be to add or maintain longs in the bond market.

Keep in mind that bond market has been rallying for over 30 years, and yields have been declining for the same period. This trend will eventually come to an end. The question is whether it has already ended or will end with one for decline.

In either case, bond yields will not go up right away. They will go up if the economy continues to improve and Federal Reserves raises interest rates couple of times. Fed's changes to short-term interest rates does not directly impact the longer-term interest rates because those rates are driven by market expectation.

In the next blog post, we will discuss the bond market structure and both Bull and Bear scenarios. Poor bond market is in no one's favor and the central banks will try their utmost to ensure interest rate rise remains in control. From an investment perspective, we might see 1 or 2 more opportunities to fund big capital purchases at a lower interest rate.

If interested in free e-mail list or in paid services, please fill-out the form below.