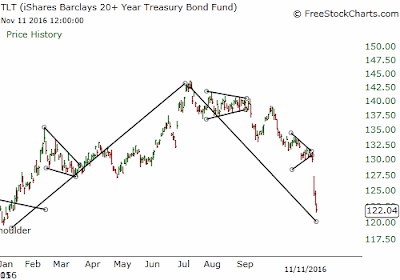

After a dynamic and super-charged start of 2016, the long-term bond prices, as measured by TLT, are at the same level where they started the year - 120.6 vs 120.7 (shown below).

Above chart shows the amazing ascent and first six months and the sharp decline over past 4 months. Today's news is full of negative articles about the bond market rout, and potential consequences.

Bond market is the life blood of modern economies. There is hardly any developed country in the world that is debt free. Countries issue debt/bonds to implement development projects and repay any interest/payments that are due on existing obligations.

United States is a unique case where the government cannot just keep issuing bonds to raise money without any checks and balances. These checks and balances help keep the government debt in control, which supports the dollar and increases confidence among the lenders that they will get their money back.

This check/balance process is known as the debt-ceiling. Without confidence in the system, creditors might start hesitating in purchasing government treasuries, which could lead to higher bond yields, making it more difficult for US to finance future needs.

Orderly, rise and fall of treasury yield is very normal because it is governed by economic realities and Fed's actions. But sudden sharp rise, can be catastrophic for the overall economy. That being said, we are in a long-term downtrend in the bond yields, which will reverse one day in the near future.

Long-term view

In early 1980s, long-term treasuries were yielding 14%. They went as low as 2% in July 2016 - amazing time to refinance or make a big purchase at next to no interest rate.

However, this kind of decline will not last for ever. Typically, there is a ~30 year bond market cycle and right now we are near the bottom of the yield cycle. Following chart shows the yield decline structure.

Now the question is whether this trend has ended or does it have one last decline left in it?

From a fundamental perspective, it is difficult to rationalize how the inflation can pick-up with oil, gold and other commodities being hit with higher dollar. If dollar rallies, it will pressure inflation and as a result, yields would come down.

Short-term View

From a short-term perspective, bond market has become extremely oversold. The sentiment is conducive to a sharp rally, as investors start to rationalize higher yields through new post-election economic realities. DSI sentiment is also extremely subdued.

Note - Election or no-election, economic realities don't change randomly. Rather, their interpretation changes but in the end everything cancels out in the direction of the primary trend

Following chart shows the near-term structure of the bond market. There are two ways to decipher this structure, but both ways suggest that this is a corrective structure. Below chart shows both the wave counts.

We will continue to monitor the bond market as we approach next month's Fed FOMC meeting. Fed might not raise the rates after an election surprise, which could give a boost to bond market.

Last Word

A collapse of the bond market will be a very bad scenario for investors and the economy. Abrupt rise in interest rates can destroy US abilities to pay existing obligations and could lead to a significant market impact. This impact might start from the US but could quickly spread through out the world. And once such a spiral starts, it is almost impossible to halt it in the middle.

If you are an investor with a substantial portfolio in bonds, you need to carefully watch for trend change in the bond market. Our proprietary Market Classification Model remains in a bull market for Bonds.

Above chart shows the amazing ascent and first six months and the sharp decline over past 4 months. Today's news is full of negative articles about the bond market rout, and potential consequences.

Bond market is the life blood of modern economies. There is hardly any developed country in the world that is debt free. Countries issue debt/bonds to implement development projects and repay any interest/payments that are due on existing obligations.

United States is a unique case where the government cannot just keep issuing bonds to raise money without any checks and balances. These checks and balances help keep the government debt in control, which supports the dollar and increases confidence among the lenders that they will get their money back.

This check/balance process is known as the debt-ceiling. Without confidence in the system, creditors might start hesitating in purchasing government treasuries, which could lead to higher bond yields, making it more difficult for US to finance future needs.

Orderly, rise and fall of treasury yield is very normal because it is governed by economic realities and Fed's actions. But sudden sharp rise, can be catastrophic for the overall economy. That being said, we are in a long-term downtrend in the bond yields, which will reverse one day in the near future.

Long-term view

In early 1980s, long-term treasuries were yielding 14%. They went as low as 2% in July 2016 - amazing time to refinance or make a big purchase at next to no interest rate.

However, this kind of decline will not last for ever. Typically, there is a ~30 year bond market cycle and right now we are near the bottom of the yield cycle. Following chart shows the yield decline structure.

Now the question is whether this trend has ended or does it have one last decline left in it?

From a fundamental perspective, it is difficult to rationalize how the inflation can pick-up with oil, gold and other commodities being hit with higher dollar. If dollar rallies, it will pressure inflation and as a result, yields would come down.

Short-term View

From a short-term perspective, bond market has become extremely oversold. The sentiment is conducive to a sharp rally, as investors start to rationalize higher yields through new post-election economic realities. DSI sentiment is also extremely subdued.

Note - Election or no-election, economic realities don't change randomly. Rather, their interpretation changes but in the end everything cancels out in the direction of the primary trend

Following chart shows the near-term structure of the bond market. There are two ways to decipher this structure, but both ways suggest that this is a corrective structure. Below chart shows both the wave counts.

Last Word

A collapse of the bond market will be a very bad scenario for investors and the economy. Abrupt rise in interest rates can destroy US abilities to pay existing obligations and could lead to a significant market impact. This impact might start from the US but could quickly spread through out the world. And once such a spiral starts, it is almost impossible to halt it in the middle.

If you are an investor with a substantial portfolio in bonds, you need to carefully watch for trend change in the bond market. Our proprietary Market Classification Model remains in a bull market for Bonds.

If interested in free e-mail list or in paid services, please fill-out the form below.

No comments:

Post a Comment

I would love to hear from you! Please leave your comment below!!