- Bond Market Analysis

- Gold Analysis (Part 1 - Structure, Part 2 - Sentiment)

Tuesday, December 6, 2016

November Review and December Forecast

Wednesday, November 30, 2016

Bond Market Buy Signals

This decline has resulted in multiple bond indicators turning bullish i.e. sentiment turning so pessimistic that it is now bullish. Three widely followed sentiment indicator readings are given below:

1- Hulbert Sentiment Index:

The blue line below represents bond yields. Bond yields move in the opposite direction to the bond prices. Red line indicates the sentiment towards bonds. At this point, it appears that the sentiment is as negative as we have seen in ~2 years. Therefore, there is a good wall of worry to support a bond rally.

2- Bund Sentiment

Bunds are German bonds. Bunds were among the bonds that went into negative yield territory. While they were negative, everyone was bullish on the future of Bunds. However, very few realized that it was more close to the end of the Bunds rise. On the contrary, right now investors are very bearish on Bunds. This suggests that this a good time to increase exposure to bonds

3- Bond Sentiment NDR indicator

According to NDR services, bond sentiment is now extremely pessimistic, which supports the argument that the Bond decline is over-extended and we should anticipate a rise in Bond prices:

Bond Market Trend

While we are seeing some very pessimistic sentiment readings, these are coming at a time when the Bond market remains in a bull market according to our proprietary Market Classification Model. Therefore, the prudent trade right now would be to add or maintain longs in the bond market.

Keep in mind that bond market has been rallying for over 30 years, and yields have been declining for the same period. This trend will eventually come to an end. The question is whether it has already ended or will end with one for decline.

In either case, bond yields will not go up right away. They will go up if the economy continues to improve and Federal Reserves raises interest rates couple of times. Fed's changes to short-term interest rates does not directly impact the longer-term interest rates because those rates are driven by market expectation.

In the next blog post, we will discuss the bond market structure and both Bull and Bear scenarios. Poor bond market is in no one's favor and the central banks will try their utmost to ensure interest rate rise remains in control. From an investment perspective, we might see 1 or 2 more opportunities to fund big capital purchases at a lower interest rate.

If interested in free e-mail list or in paid services, please fill-out the form below.

Sunday, November 27, 2016

Gold Market Sentiment & Structure Confluence

Gold Sentiment

Gold sentiment has dipped to levels last seen near last year's lows. Following snap shots are from Daily Sentiment Index values on Nov 21.

Following chart shows longer-term DSI values (originally published by Taylor Dart). We can see that DSI is at lowest levels seen in last year.

Gold miners are also extremely oversold. They are at levels where we have seen major bounces in the past. This bounce can turn into major rally, dependent on internal market strength.

Market Classification Model

Along with all the positive developments on the sentiment front, the Market Classification Model remains in a bull market for Gold. As a result, we should not only expect a bounce but a resumption of the uptrend. This resumption could lead to acceleration to the upside. If the market completes the inverted head and shoulders pattern, we could easily see 1800 in 2017.

In the next blog post, we will discuss Fundamental reasons that could support this rise in Gold prices including asset rotation and Indian decision to restrict currency.

If interested in free e-mail list or in paid services, please fill-out the form below.

Tuesday, November 22, 2016

Gold Market - Approaching a Turn

- Intermediate term Gold structure

- Longer-term goal structure

- Market Classification Model

If interested in free e-mail list or in paid services, please fill-out the form below.

Monday, November 14, 2016

Bonds Market Analysis and Impact

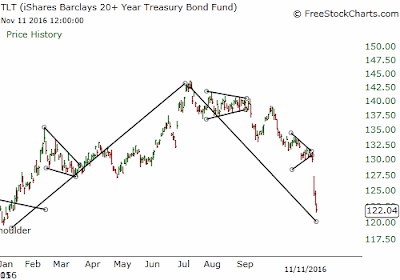

Above chart shows the amazing ascent and first six months and the sharp decline over past 4 months. Today's news is full of negative articles about the bond market rout, and potential consequences.

Bond market is the life blood of modern economies. There is hardly any developed country in the world that is debt free. Countries issue debt/bonds to implement development projects and repay any interest/payments that are due on existing obligations.

United States is a unique case where the government cannot just keep issuing bonds to raise money without any checks and balances. These checks and balances help keep the government debt in control, which supports the dollar and increases confidence among the lenders that they will get their money back.

This check/balance process is known as the debt-ceiling. Without confidence in the system, creditors might start hesitating in purchasing government treasuries, which could lead to higher bond yields, making it more difficult for US to finance future needs.

Orderly, rise and fall of treasury yield is very normal because it is governed by economic realities and Fed's actions. But sudden sharp rise, can be catastrophic for the overall economy. That being said, we are in a long-term downtrend in the bond yields, which will reverse one day in the near future.

Long-term view

In early 1980s, long-term treasuries were yielding 14%. They went as low as 2% in July 2016 - amazing time to refinance or make a big purchase at next to no interest rate.

However, this kind of decline will not last for ever. Typically, there is a ~30 year bond market cycle and right now we are near the bottom of the yield cycle. Following chart shows the yield decline structure.

Now the question is whether this trend has ended or does it have one last decline left in it?

From a fundamental perspective, it is difficult to rationalize how the inflation can pick-up with oil, gold and other commodities being hit with higher dollar. If dollar rallies, it will pressure inflation and as a result, yields would come down.

Short-term View

From a short-term perspective, bond market has become extremely oversold. The sentiment is conducive to a sharp rally, as investors start to rationalize higher yields through new post-election economic realities. DSI sentiment is also extremely subdued.

Note - Election or no-election, economic realities don't change randomly. Rather, their interpretation changes but in the end everything cancels out in the direction of the primary trend

Following chart shows the near-term structure of the bond market. There are two ways to decipher this structure, but both ways suggest that this is a corrective structure. Below chart shows both the wave counts.

Last Word

A collapse of the bond market will be a very bad scenario for investors and the economy. Abrupt rise in interest rates can destroy US abilities to pay existing obligations and could lead to a significant market impact. This impact might start from the US but could quickly spread through out the world. And once such a spiral starts, it is almost impossible to halt it in the middle.

If you are an investor with a substantial portfolio in bonds, you need to carefully watch for trend change in the bond market. Our proprietary Market Classification Model remains in a bull market for Bonds.

Thursday, November 10, 2016

Post Election Investment World

Such a market action in the face of presidential uncertainty is amazing. Although it bodes very well for the overall economy, we will talk about potential Trump impact in the upcoming post.

From an investment perspective there are different scenarios that one needs to be aware of.

Stock Market:

As stocks break out into uncharted territory and Nasdaq approaches the vacuum zone, it means that we are on the cusp of a major rally.

Like many rallies before it, this rally will also be debated by market participants as to why would market rally while president's economic plan would mean job losses. However, the pattern suggests that the stock market remains in a bull trend.

In essence, the underlying economy is very strong and would result in strong growth without any external influence. We will discuss internal structure of the market in future posts.

Bond Market:

Bond market's sharp sell-off probably suggests that the long-term bond bull market has ended. We are probably on the cusp of a significant inflation cycle. Near zero bonds are a thing of the past. Even though we might see some respite from the Federal Reserves, which might hold-off on the decision to increase the interest rates, we are surely in for higher rates.

Following chart shows a very long-term bond yields. Post-election rally has broken a long-term down trend line - another confirmation of the trend change. We have been keeping track of this wave count for years now and have discussed potential bond yield bottom with clients.

Many of our clients bought houses, properties etc in the last 2 years!

This market behavior has significant consequences for investors and we will discuss these consequences in detail. However, one should keep in mind that this kind of behavior will not result in bonds going to stratosphere in the near future. In fact, after couple more months of rising yields, yields might see a very sharp correction.

Metals

Copper has rallied very sharply over the past few days. Precious metals rallied on the news of potential Trump win - fear trade, but since then have declined. This decline was a significant intra-day reversal. But the overall trend in metals remains up.

Gold could continue to rally in anticipation of a higher inflationary environment. So will the gold stocks. Gold and Silver are tracing out very interesting patterns and could have significant upside potential if the can break above 1320 in Gold. We will also discuss the gold pattern in the near future. Past analysis on gold accurately predicted the bottom in October.

Portfolio Allocation:

Our proprietary model has performed extremely well in 2016. It not only kept us in the market during relevant bull phases, it also enabled us to maintain our calm whether during Brexit shock or Trump shocker. Any portfolio that can:

- Yield returns which are uncorrelated to the market

- Save a lot of heart-burn when the market goes against you by 1000s of points whether in futures or cash

- Provide you consistent returns AND

- Mitigate volatility and provides very high Sharp ratio

Tuesday, November 8, 2016

Reasons to be Bullish - From Twitter

Market completed longer term corrective pattern - Higher prices ahead? https://t.co/lyQxShgxmX $SPY $DJIA $QQQ pic.twitter.com/SeQjjd6D9P

— U_S_Thrive (@survive_thrive) November 8, 2016

A rerun chart from last week. VIX now now longer above all its futures contracts. Looks therefore like it was a scary dip, not a downtrend. pic.twitter.com/xyklR0F14r

— Tom McClellan (@McClellanOsc) November 7, 2016

$VIX term structure suggests that we are approaching an inflection point but note that it has spiked much higher in a few cases#volatility pic.twitter.com/s36s0ZnGun

— Babak (@TN) November 3, 2016

Options Traders Ramp Up Put Buying As Fear Spikes - https://t.co/bq51yqoc8t blog by @JLyonsFundMgmt $SPY pic.twitter.com/UGvsSzqECd

— See It Market (@seeitmarket) November 7, 2016

Chart Of The Week (by views): Investors (Over?-)Prepared For Election Volatility (11/1) $VXST

— Dana Lyons (@JLyonsFundMgmt) November 5, 2016

Post: https://t.co/p7piJzdNeI pic.twitter.com/lOpF6pMibP

we have yet to see any panic from the CBOE equity put/call ratio (normalized by dividing 10d/150d MA) $OEX P/C ratio still negative for mkt pic.twitter.com/z2wvkaDdmv

— Babak (@TN) November 4, 2016