We started investing in Gold in 2016 April, after 4 years of being out of the Gold market. We again increased Gold exposure at the start of 2017, in our proprietary strategies (Jan / Feb

2017 Investment Strategies' Performance). Overall, Gold remains in an uptrend but recent development has made us wary of immediate upside of Gold.

In this post, we have analyzed Gold's short-term prospects using multiple analysis techniques to showcase the rationale behind our caution:

Technical

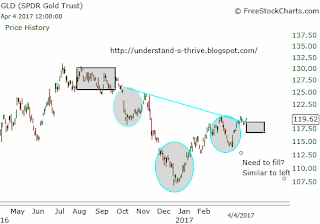

After experiences a sharp decline in early March, Gold has rebounded nicely. It is now testing significant trend-lines (show

below). These trend lines could act as resistance in the near-term and force Gold to consolidate.

Sentiment

While Gold could experience a pause, it will be a very constructive development. But what is not constructive is the fact that news media has recently turned bullish on the yellow metal. Following are some of the recent bullish Gold headlines:

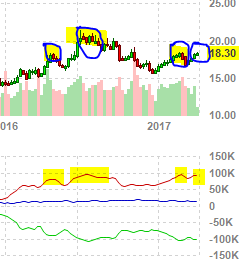

Furthermore, other sentiment indicators also suggest that Gold and Silver are in for some turbulence. Following chart shows Silver positioning among large and small traders. Current positioning is at levels that have resulted in Silver going down or sideways.

One cannot believe the financial news media because they get behind a trend, once everyone is on board. A detailed analysis of 2016 news and market action is presented here. Therefore, investors need to remain objective in terms of their direction and action plan.

Short-term structure:

With sentiment picture on the optimistic side, its likely that the trend will experience some pause before really asserting itself in the next few days. Above chart shows a potential inverted head and shoulders pattern being formed in Gold. However, the right shoulders doesn't look complete. Some back and forth action will be ideal to complete this structure.

Gold Influence

Gold is significantly influenced by USD and Euro. Strong

dollar pressures the commodities complex. It looks like Dollar has completed a long-term

correction since the start of 2017, and could rally for few weeks. Start of 2017 is the same time when Gold start rallying. Once US Dollar rallies, it

would be negative for Gold and Silver markets.

Furthermore, Euro long positions are also very extreme,

which means that Euro will soon experience correction. Euro decline will also fuel Dollar rise; another reason that

could dampen Gold’s ascent.

Conclusion

Gold could experience some resistance around these

levels because of technical, sentiment and influence from other areas. However, that

doesn’t mean that Gold will not spring back or it has entered a down trend. In

financial analysis, one needs to remain objective.

How are we positioning?

We have reduced our long exposure but maintain long positions because Gold remains in an uptrend, as per proprietary Market Classification Model. Details will be shared with subscribers by April 9th. Our conservative proprietary strategy has out-performed the

market in 2016 and in Q1-2017 through objective risk-management and a combination

of strategic & tactical allocation. Detailed performance analysis will be shared in next 2 weeks.

Want to Invest

You can invest in these strategies

through “Managed Account” offering or by subscribing

to some of the services like Market classification Model (subscription page). MCM serves as the

backbone for our model and can help you develop an understanding of the

markets. If interested in investing, you can register below and we will send an update.

No comments:

Post a Comment

I would love to hear from you! Please leave your comment below!!