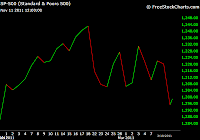

Although the UST proprietary market index is in a downtrend and in a pronounced bear market, major indices like SP500 and DJIA are holding up. However, the following chart shows the possibility of a series of 1s and 2s in the stock market. If this Elliott Wave analysis is true, we might be in for a sharp decline really soon.

On a larger scale, markets are tracing out a Head and Shoulder's pattern. This pattern would mean that we are about to embark on a sharp down move. This pattern will be confirmed of a decline below 1185 (SP500.

INFLECTION POINT MODEL:

The Inflection Point Model predicted that the markets could top on December 5, 2011. Dec 5 has so far turned out to be the top date for Nasdaq and Russell 2000, with DJIA and SP500 topping 2 days later. It seems like the next turn date is 2-3 weeks away (chart given below). Exact date has been calculated and will be sent to the subscribers. Please note that IPM showed a top when everyone was looking forward to the end of year, Santa Claus rally.

Lets see what the last two weeks of 2011 bring for the markets. Please note that according to our wave and time analysis, we are about to witness a sharp decline in to the end of the year. As always, this scenario is bounded with 1250 (SP500) level. A break above this level, will nullify the decline potential.

SHORT TRADE:

We will bring down the stops to 1230, once the market decline sharply.

Note: UST market update frequency will increase after December 21, 2011

On a larger scale, markets are tracing out a Head and Shoulder's pattern. This pattern would mean that we are about to embark on a sharp down move. This pattern will be confirmed of a decline below 1185 (SP500.

INFLECTION POINT MODEL:

The Inflection Point Model predicted that the markets could top on December 5, 2011. Dec 5 has so far turned out to be the top date for Nasdaq and Russell 2000, with DJIA and SP500 topping 2 days later. It seems like the next turn date is 2-3 weeks away (chart given below). Exact date has been calculated and will be sent to the subscribers. Please note that IPM showed a top when everyone was looking forward to the end of year, Santa Claus rally.

Lets see what the last two weeks of 2011 bring for the markets. Please note that according to our wave and time analysis, we are about to witness a sharp decline in to the end of the year. As always, this scenario is bounded with 1250 (SP500) level. A break above this level, will nullify the decline potential.

SHORT TRADE:

We will bring down the stops to 1230, once the market decline sharply.

Note: UST market update frequency will increase after December 21, 2011