Financial markets have gone sideways over the last two weeks. This kind of sideways action means that the market is coiling up energy to break in either up or down direction. Along with the price action, technical indicators are also coiling up energy. This would lead to a sharp move in the stock market. Therefore, one should be ready with strict risk-management strategies.

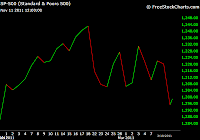

There have been various instances in the past when such sideways movement resulted in market tops. Plots of previous major tops (April 2010 and Feb 2011) are shown below. If we are currently witnessing a top formation, it would suggest that the market is tracing out a series of 1s and 2s, which would lead to a sharp decline to 1100s in SP500. Under this scenario, market should not break above 1275 (SP500).

April 2010 Top

Feb 2011 Top

Nov 2011 Top?

This development in conjunction with the detailed market structural analysis, Fibonacci relationships and supporting market structures (sent to subscribers last week), support the fact that the market has completed a counter trend rally from October 4, 2011 low.

At the same time, optimism is also reaching elevated levels as seen through Individual Investors, Rydex investors and other ratios. Therefore, sentiment is supporting the possibility that markets topped on October 27, 2011 (until unless market breaks above 1275 SP500).

During the recent sideways market action, it was noticed that bulls got emboldened and started to bet on the Santa Claus rally. Furthermore, recent up down gyrations whipsawed a lot of investors out of the market. Since markets are notorious about getting rid of majority of traders (long or short) before initiating the major move, we might be on the cusp of sharp move in the financial markets (rally or decline).

Tonight or tomorrow, Understand, Survive and Thrive will publish the Daily Inflection Point Model, this model has some very important dates to keep in mind over the next few weeks, especially with respect to End of Year Rally.

No comments:

Post a Comment

I would love to hear from you! Please leave your comment below!!