H1 2018 has been very interesting. We started the year after an amazing 2017 and had a very good January. But January generated few sell signals and then everything got very interesting. SP500 declined sharply for two moths with a ~10% draw-down from January top to March bottom.

While 2018 has not been a typical banner year of out-performance for our proprietary investment strategies, it has highlighted two very valuable aspects of these strategies, aligned with our goal of generating value for investors (not just trying to beat the market because just beating the market carries risk and additional tax/transaction costs):

- Consistent returns with dampened volatility in comparison with major stock indices

- Uncorrelated performance: Returns not dependent on market performance

2018 started with an outstanding January with SP500 (TR) rallying more than 5.7%. During the same time our conservative strategy under-performed the market, while aggressive strategy out-performed SP500.

At the end of January, we received a sell signal in the stock market because of which we ended our long positions and built a very small short portion. This sell signal played out very well as we moved in to February and witnessed a 10% decline in major US indices. From March through May, US markets tested key levels multiple times but did not break down.

This is a very interesting observation because we were positioned to avoid loses due to the breakdown and potentially take advantage of the decline. As a result, our portfolios did not perform as well when the market avoided decline. But our purpose was to avoid losses to ensure long-term growth, rather than just buying and holding, which is also equal to buying and hoping.

This is a very interesting observation because we were positioned to avoid loses due to the breakdown and potentially take advantage of the decline. As a result, our portfolios did not perform as well when the market avoided decline. But our purpose was to avoid losses to ensure long-term growth, rather than just buying and holding, which is also equal to buying and hoping.

The sell signal ended in May, and we went long stocks again in June. On the other hand, we have received several other buy signals in other assets, and have positioned our strategies to take advantage of such signals.

Portfolio Strategies

Portfolio Strategies

We currently have two live strategies, and are working on 3 more strategies in Beta phase. Goal for both of these strategies is to generate absolute, uncorrelated returns:

- Conservative (EPSB): Suitable for retirement accounts and risk-averse investors

- Aggressive (AEPSB): Suitable for risk taking investors, with longer-term invest goals

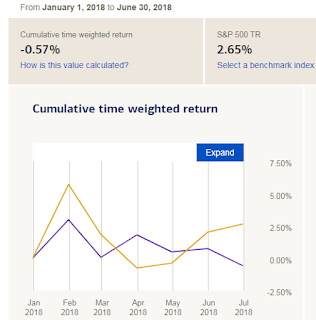

Conservative Strategy: -0.6% vs +2.7% for SP500 (w/ dividends)

In 2018 conservative strategy has shown it's low-correlation and low-volatility characteristics with negligible correlation with SP500 monthly returns. This low correlation is also evident from performance since inception data. The monthly total draw-down for SP500 was ~6.5% vs -3.6% draw-down of the conservative strategy. Monthly volatility of this strategy has been half of SP500, which means once it starts out-performing again, it' risk adjusted returns will be outstanding.

Aggressive Strategy: -6.1% vs +2.7% for SP500 (with dividends)

While aggressive strategy has under-performed SP500, it has also shown significantly lower volatility. And is positioned to benefit from aligned moves.

Management Fees Refund

Keeping all the good aspects aside, investment strategies have under-performed in 2018. If the year end performance is negative and less than SP500, we will refund investment management fees for 2018.

Conclusion

The best aspect of these strategies is that they enable the investor to concentrate on the work that is more important in life than losing sleep over investments through daily news.

We don't think the volatility will subside right away, and could see another leg down but that will be a good buying opportunity, if no sell signals are generated. One of the best things one can do at this time, in regards with their portfolio, is to see if their portfolio is positioned to absorb increased volatility, and better yet, can they benefit from volatility. Our strategies don't depend on market news, rather take into account underlying market tones to make investment decisions. This reduces transaction cost, dampens volatility, moves taxes to long-term bucket and generate consistent results for long-term benefits.

These strategies are open for investment. Please feel free to contact via subscription.ust@gmail.com for details. These strategies are being implemented via managed account setup through a Registered Investment Adviser.

These strategies are open for investment. Please feel free to contact via subscription.ust@gmail.com for details. These strategies are being implemented via managed account setup through a Registered Investment Adviser.

Please contact us for details. You can also sign-up for free email updates below:

No comments:

Post a Comment

I would love to hear from you! Please leave your comment below!!