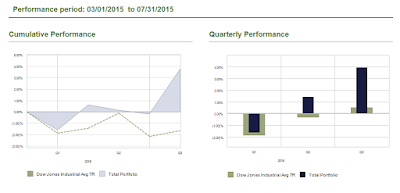

In an environment when Greek deal was so uncertain that Greek was almost booted out of the European Union, at a time when corporate earnings had started to disappoint and in face of Federal Reserve's anxiety around interest rate hike, IOM portfolio once again outperformed the market. Since March 2015, IOM has lead the market by 5.7% (model is up 3.7%, while total return DJIA is down 1.7%).

In other words, model has generated Alpha without taking on very much risk. In built, risk management mechanisms have ensure removal of underperforming stocks and heavier allocation to stocks with great fundamental and technical pictures.

This outperformance is especially significant because it came at a time when the global markets were very uncertain. Following chart shows the market performance since March 2015.

The investment optimization model (IOM) has been developed to manage risk and amplify gains. In order to do so, the model is deigned to out-perform its benchmark in following three distinct environments: :

1- A market which is trending up

2- A market which goes sideways and down

3- A Bear market

In an up-trending market, the model's components will outperform its benchmark because the stock selection is based on a systematic method of identifying stocks exhibiting certain features and higher gain potential.

At the same time, strict risk management process ensures that if a single entity is doing bad, asset allocation is reduced. For example, last month LinkedIn was removed and this month Chipotle has been added back into the portfolio.

In a sideways market, like right now, the model is designed to outperform and preserve capital.

Finally, in a bear market, model will not only preserve capital using proprietary risk-management strategies, it will also short the market and diversify in other asset classes.

Therefore, the model is very holistic and so far in 2015, it has proved to be very valuable. Moving forward, we are working on enhancing the model with additional business rules to not only amplify portfolio's return potential but also to forewarn about an impending bear market. We will keep the blog updated with latest performance and enhancements.

In other words, model has generated Alpha without taking on very much risk. In built, risk management mechanisms have ensure removal of underperforming stocks and heavier allocation to stocks with great fundamental and technical pictures.

This outperformance is especially significant because it came at a time when the global markets were very uncertain. Following chart shows the market performance since March 2015.

1- A market which is trending up

2- A market which goes sideways and down

3- A Bear market

In an up-trending market, the model's components will outperform its benchmark because the stock selection is based on a systematic method of identifying stocks exhibiting certain features and higher gain potential.

At the same time, strict risk management process ensures that if a single entity is doing bad, asset allocation is reduced. For example, last month LinkedIn was removed and this month Chipotle has been added back into the portfolio.

In a sideways market, like right now, the model is designed to outperform and preserve capital.

Finally, in a bear market, model will not only preserve capital using proprietary risk-management strategies, it will also short the market and diversify in other asset classes.

Therefore, the model is very holistic and so far in 2015, it has proved to be very valuable. Moving forward, we are working on enhancing the model with additional business rules to not only amplify portfolio's return potential but also to forewarn about an impending bear market. We will keep the blog updated with latest performance and enhancements.

No comments:

Post a Comment

I would love to hear from you! Please leave your comment below!!