May was a rough and volatile month for the markets. It was marked by uncertainty and a volatile bond market. Investors were freaked-out by the poor economic numbers of the first quarter, along with poor indicators like housing starts etc. At the same time, the bond market was undergoing very sharp swings, highlighting the angst bond investors were experiencing in the face of upcoming rate hike by the Federal Reserves.

Rate increase by the FED will cause the rates to increase across the entire spectrum. As we know, rate increase results in a decrease in value, which would result in huge market losses for bond investors. In order to avoid such losses, many investors were rushing to the exit.

May's choppy market action is showcased by the following chart, which shows DJIA over the month of May. As you can see the market saw wild swings but overall rise was minimal.

At the end of the month, DJIA managed to gain slightly more than 1%. However, the model portfolio lost 0.4%. Since the model's goal is to generate results in any market, May's under performance was an anomaly. So far the model portfolio has beaten the market since November 2014.

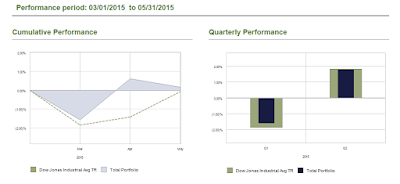

Following chart shows model's performance since March 1, 2015. We have selected March 1st because at the start of March, full account was invested per the algorithm .Therefore, this will give us the best understanding of the performance.

As mentioned before we will keep tracking the model on a monthly basis to highlight its value. Please note that the goal of the model is to beat the market by managing risk, following trend and balancing portfolio using proprietary algorithm. The model undergoes trades once a month and rest of the month there is no change to the holdings.

One of the holdings that was removed form the portfolio this month was Chipotle ($CMG). We will discuss Chipotle in greater detail in the next post.

Rate increase by the FED will cause the rates to increase across the entire spectrum. As we know, rate increase results in a decrease in value, which would result in huge market losses for bond investors. In order to avoid such losses, many investors were rushing to the exit.

May's choppy market action is showcased by the following chart, which shows DJIA over the month of May. As you can see the market saw wild swings but overall rise was minimal.

At the end of the month, DJIA managed to gain slightly more than 1%. However, the model portfolio lost 0.4%. Since the model's goal is to generate results in any market, May's under performance was an anomaly. So far the model portfolio has beaten the market since November 2014.

Following chart shows model's performance since March 1, 2015. We have selected March 1st because at the start of March, full account was invested per the algorithm .Therefore, this will give us the best understanding of the performance.

As mentioned before we will keep tracking the model on a monthly basis to highlight its value. Please note that the goal of the model is to beat the market by managing risk, following trend and balancing portfolio using proprietary algorithm. The model undergoes trades once a month and rest of the month there is no change to the holdings.

One of the holdings that was removed form the portfolio this month was Chipotle ($CMG). We will discuss Chipotle in greater detail in the next post.

No comments:

Post a Comment

I would love to hear from you! Please leave your comment below!!