Performance Review

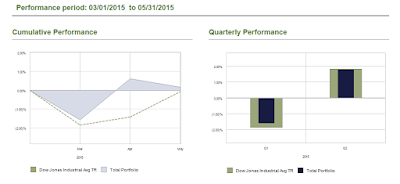

DJIA (since March 1, 2015) = -1.06%

SP500 - Total Return (since March 1, 2015) = +0.46%

Model (since March 1, 2015) = +1.97%

With model outperforming the market handsomely over the last 3.5 months and in a directionless market, it seems like it has added significant value. The best part is that the model has inbuilt risk-mitigation mechanisms, which ensure that no single stock gets extra weightage and any stock which enters its respective bear market territory, is removed from portfolio.

The best example in this regard is the removal of Chipotle from the portfolio and addition of Krispy Kreme, which rallies sharply.

In the mean time, UST team has been analyzing the model using strict stress testing mechanisms and we will share our findings on the blog.

DJIA (since March 1, 2015) = -1.06%

SP500 - Total Return (since March 1, 2015) = +0.46%

Model (since March 1, 2015) = +1.97%

With model outperforming the market handsomely over the last 3.5 months and in a directionless market, it seems like it has added significant value. The best part is that the model has inbuilt risk-mitigation mechanisms, which ensure that no single stock gets extra weightage and any stock which enters its respective bear market territory, is removed from portfolio.

The best example in this regard is the removal of Chipotle from the portfolio and addition of Krispy Kreme, which rallies sharply.

In the mean time, UST team has been analyzing the model using strict stress testing mechanisms and we will share our findings on the blog.