Last week market declined with Dow losing more than 1% in a week, with Friday being the worst day of the week. Although the decline was pretty severe on Friday, one can regard the overall market action has sideways gyration. Over the past few weeks, there hasn't been any clear direction for the market and therefore, its like that the market is setting up a base before the next breakout. However, there is a lot of news on the deck that could keep this market gyrating back and forth, before it sets the direction.

Next week will bring another deluge of earnings, which would keep the market participants on their toes, itching to press the trigger. Very basic instinct of any trader is to buy on good news as the stock rallies and sell when it is confirmed that things are going south. However, by the time it is confirmed with financial results that stock/company is doing poorly, a forward looking company management already implements policies to bring the company back on course. As a result, many stocks turn around and maintain their bull trend, as soon as bad results are announced.

This behavior gives birth to the concept of portfolio re-balancing and riding the trend. It means that as long as an individual stock is in a bull market, it will continue to rise and give way to more growth. In this regard, if one can identify the following traits, they can be very successful:

- Which stocks to invest in

- Whether selected stock is in a bull or bear market

- How much to invest in each position

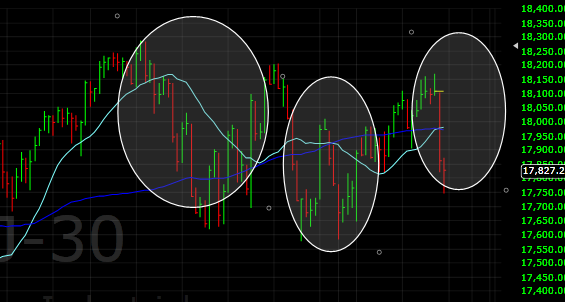

For now, market is in a long-term bull market. There was a scare but it has been dealt with. Technically speaking, market is carving out an invested Head and Shoulder pattern which, when complete, could provide a foundation for another rally. We will re-evaluate the situation on a decline below 2500 (Global Dow).

No comments:

Post a Comment

I would love to hear from you! Please leave your comment below!!